Our article will look at which shares would have made us the most profit if we had bought them between 1927 and 2019. We will talk about the so-called small cap stocks and discuss how much these stocks outperformed the U.S. stock index, the S&P 500.

We will also talk about how much differently these stocks have performed over the past decade and how well this could mean small value stocks may perform in the future.

Our topics:

- What was the result of small value investment between 1927 and 2019?

- What does small value stock mean?

- Value-glamour anomaly in the stock market

- How value shares outperform periodically

What was the result of small value investment between 1927 and 2019?

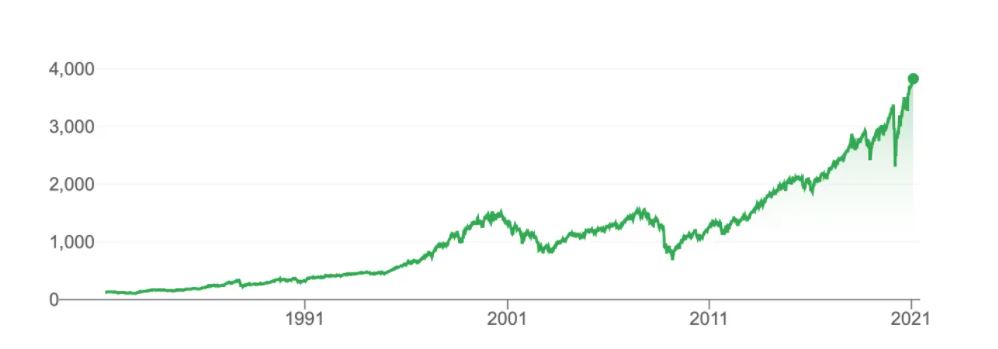

If we look at the yield on small value shares in Professor Kenneth French’s Research Portfolios database, we find that the annualised return on small value shares was 14.5% between 1927 and 2019. Meaning small value stocks outperformed the S&P 500 index by 4-5% annually, with a yield of 10.2% in the same period. So you could say that small value stocks have been the best investments in the U.S. stock market for the last 80 to 90 years, but over the last decade, the value factor has underperformed the stock market, which affects small value stocks well.

The problem with the above comparison is that we compare stock indices. Still, we cannot invest directly in stock indexes, so we get a more accurate picture when comparing specific investment products. For this purpose, I raised the Vanguard Fund Management S&P 500 Index (VOO) (VFINX) and the VB (DFA) US Small Cap Value etf.

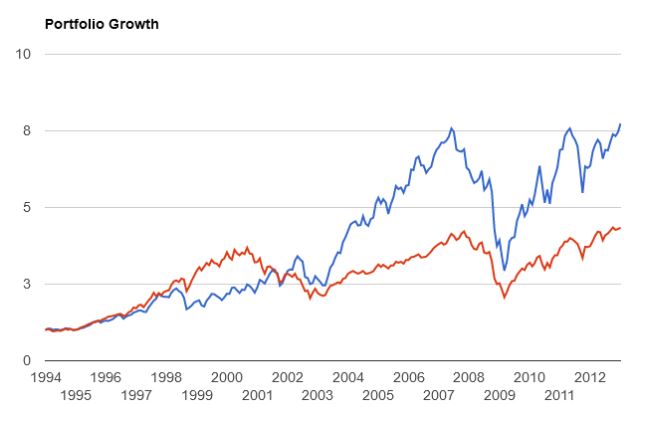

The graph below clearly shows that the small value portfolio (11.37%) outperforms the S&P 500 index (8.03%) between 1994 and 2012.

But after 2012, small value stocks (10.85%) are lagging, with the S&P 500 index outperforming by 14.73%.

However over the past decade, small value stocks – and practically the value factor – have diminished the stock market’s impact. We have considered the possible causes of this change, so let’s look at what small value shares mean.

What does small value stock mean?

A ‘small value share’ is a term for any shares with a low market capitalisation, i.e. small companies, and are underpriced based on various fundamental indicators (e.g. P/E – Price-to-Earnings ratio, P/B – Price-to-Book ratio, P/S – Price-to-Sales ratio, P/FCF – Price-to-Free Cash Flow). Investors are actually exploiting two stock market anomalies by investing in value shares; because one only invests due to the size factor, i.e. low-cap stocks have a premium yield.

Between 1927 and 2010, the average annual return on shares with the largest market capitalisation was 10%, while the average yearly return on shares with the smallest market capitalisation was 21.26%. When the U.S. stock market was split into ten different parts. This defined the largest and smallest stock categories, according to their level of capitalisation.

The smallest category of shares became the lower deciles. In contrast, the largest market capitalisation became the upper decile, meaning this group is the top 10% of shares with the largest market capitalisation. But this anomaly is observed not only in the case of shares with the most and least significant market capitalisation but continuously it has been shown that those with smaller caps can make a higher possible yield; see picture below.

For example, the 50% of shares with the smallest capitalisation would show an average annual return of 17.24%, if the value of all U.S. stock was to be halved. In contrast, the 50% of shares with the highest capitalisation would only offer a return of 13.32%.

The other is the value factor, i.e. purchasing underpriced shares on the basis that their future value will out-perform. This value factor is based on well-known investors, such as Warren Buffett’s investment methods, but backtesting has shown that the value factor is a common element even in long or short techniques.

However, the problem is that the impact of the value factor has diminished over the past decade. As a result, some indicators may no longer achieve any additional returns (yields that outperform the S&P 500 index), but some other indicators still prove effective. In any case, these are the reasons behind newspaper articles in which you read that Warren Buffett’s method of investing, or value-based investing, has failed, it is not working.

Value-glamour anomaly in the stock market

The truth is that different premiums on the stock exchanges have changed over time. As an example, let’s mention the most well-known premium, the risk premium of the stock market, which also forms the basis of the CAPM (capital Asset Pricing Model) and shows a decades-old correlation, i.e. investors receive a return premium in exchange for equity market risk. This yield premium averages 8.24%, and at a stat value higher than 2 (3.91), indicating a statistically significant result. This is a robust, significant observation, and the value factor is similar.

However, in the case of the risk premium, we also find that it is not always positive. We will use the following periods: 1929 – 1943, 1966 – 1982, and 2000 – 2012 to highlight this. In all of these periods, the risk premium of the stock market was negative – the S&P 500 index would have given you a lower return than risk-free investments would have done. Let’s also discuss that, if we take an even more comprehensive retrospective look, there have been several negative risk premiums in the past.

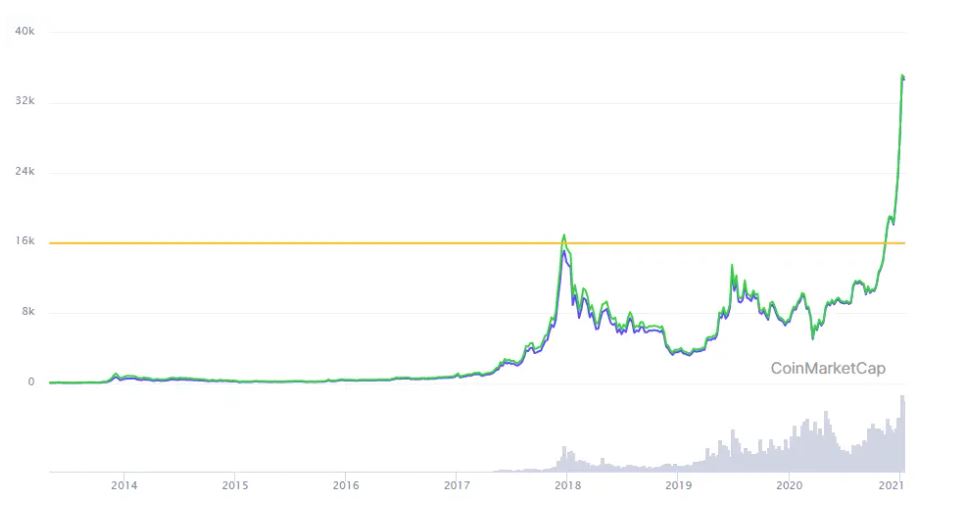

As you can see, not so long ago,the risk premium was negative in periods of 10-12 years, therefore the fact that the value premium has been negative for the same length of time, is a trend more than it is a surprise. The presence of this extended period isn’t a surprise, simply because stock markets have longer cycles, but as you can see in the graph above, the value premium averages 4.7% per annum.

We have also talked about the reasons behind the underperformance of value shares, and in this article the so-called value-glamour anomaly also appears, i.e. popular growth shares (glamour) underperform the shares selected based on their longterm value, but it is still possible that growth shares can outperform in the short term.

Value shares outperform periodically

It is worth being aware that the returns available on the stock market and stocks also change over time, so while it sounds reasonable that the yield of the S&P 500 index is 10% per year, this average is calculated over a period of 90-years. Over a shorter investment horizon (e.g. 5-10 years), yields are significantly spread relative to the average, depending on valuation.

The graph below shows the P/E ratio (Price-to-Earnings ratio) of the S&P 500 index over the past 25 years. Over the past 25 years, the average P/E of the S&P 500 index has been 16.39. The graph also shows the boundary of single standard deviation (13.24 and 19.54) with dashed lines, i.e. assuming a normal distribution, the P/E ratio moves in the range 13.24 to 19.54 for 67 per cent of the period. And if the P/E rate leaves this band, we will see a level of appreciation that is relatively rare (33% of the time).

If we look at the double standard deviation, the P/E ratio varied between 10.63 and 23.23 in 95 per cent of the period.This means that above 23.23 (now 21.72), we will witness a rare event with a probability of 5% based on data from the last 25 years.

The problem is that a high P/E ratio predicts low future returns. For example, in the photo below, you can see the 1-year forecast. The descending yellow line shows that with the increase in the P/E ratio (on the X axis), the available annual yield falls (Y axis). The problem is that the standard deviation of the data is substantial. In some years, yields are very far from the yellow curve, i.e. the indicator is unsuitable for an annual forecast (the correlation factor of 9% indicates this).

In the case of forecasting five-year annualised yields, the forecast is much more accurate. The standard deviation of the data is smaller, but this also shows us the above correlation. Or a more accurate (80% correlation factor) is the Shiller P/E ratio.

The essence of the above is that the rise in the stock market is typically driven by growth shares, so value shares underperform in the mature phases of a bull market when it comes to the stock market. You can see an example of this in the graph below, where you can see an index in yellow showing the largest 1,000 growth companies in the U.S. stock market. In grey, is the most sizeable price of 1,000 value shares.

It can be clearly seen in the picture above that in the bull market preceding the dotcom bubble, growth shares outperform significantly, and then by the end of the crisis, they fall back to the same level as value shares. This is followed by the period when value stocks begin to outperform.

And then, over the past 10 years, growth stocks have outperformed strongly, and the gap will widen spectacularly after 2015. At present, the P/E ratio increase correlates with growth shares’ price increasing.

And if we compare the valuation of value and growth shares, we can see a similar situation. In the picture below, you can see that before the dotcom bubble (2000), growth shares will become more and more expensive fundamentally (downward curve). Then the valuation of growth shares will again approach reality (falling prices on the stock exchanges, this will improve the P/E ratio). However, over the past five years, we have seen that growth shares have become more and more overpriced, when compared to value shares (the curve is falling).

Therefore, we have seen that growth shares outperform value shares over time in certain periods. However, over more extended periods, value shares usually outperform. There are also logical reasons for the overperformance of growth stocks; think of the irrational behaviour of some investors in the stock market. Even in longer periods of time, momentum drives up prices, but this results in an overpriced situation (and in-turn predicts lower future returns).

The bad news for investors is that such overpriced situations can persist for years, and as previous examples show, there’s nothing special about an effect not working on stock markets over a 10-year horizon. Of course, small value and value shares may outperform again sooner or later, but this will have to wait.

The topics that we have/will cover are: stock market trading, stock market investing, correlations that could result in additional ROI, facts and misconceptions about the Stock Exchange and stock market anomalies, as well as many more!

Before considering investing in small-cap stocks you should do your own research (DYOR) on them. To help get you started, we have found a great article that will bring you some extra knowledge.

Read more from Us