Are you intrigued by the concept of investing and want to learn more about investments? Then you’re in the right place!

This article will present the most important investment basics, that beginners need to know. We will also look at why investing is beneficial and what you may miss out on if you don’t take advantage of it.

If you want to build wealth — either for retirement or to achieve financial freedom — usually, it isn’t enough to make money and save some of it.

As Robert Kiyosaki said, “For every dollar you save, you can give a work suit and send it to make more money for you.”

Today, anyone can invest, with a few hundred dollars and a phone with an internet connection, anybody can get started.

However, the world of investing can seem complicated, and we often don’t know how to get started in the first place. We can find ourselves in a real sea of jargon on the Internet, where sometimes it is difficult to find the best of the available information.

Because of this, many people don’t even start investing and so, due to inflation, they continue to lose money without even realising. With the right basic knowledge, investments can be made to be much more simple.

This article will give you all of the most important information that you would need as a beginner starting out on your investment journey.

As there is a lot of information packed into this article, please see our Table of Contents below:

1) What is Investing?

1.1) 1. Cash flow / Direct income

1.2) 2. Capital gains

1.3) 3. Cash flow + Capital gains

1.4) Investment means the purchase of income-generating assets

1.5) The Difference Between Investing and Speculation

1.6) Investor Vs. Speculator

2) Why is it important to invest?

2.1) Why is it not enough to save?

2.2) Build Wealth With the Power of Interest

3) When should you start investing?

4) Misconceptions about investing

4.1) Myth 1: Investing is Difficult/ Complicated

4.2) Myth 2: The Luck of Investing

4.3) Myth 3: It Takes a Lot of Money to Invest

4.4) Myth 4: Only The Rich and Professionals Can Invest

5) Investment Funds

5.1) 1. The Main Asset Classes

5.2) 2. The Correlation between Return On Investment (ROI) and Risk Exposure

5.2.1) High Yield, Low Risk?

5.3) 3. Diversification

5.3.1) Think in portfolio

5.3.2) ETFs: One of the Best Tools for Diversification

6) Investment Concept: Summary

What is Investing?

By investing, we mean a long-term process of buying income-generating assets with the aim of earning a return from it in the future.

Self-made money-man Warren Buffett once said:

“Investing is giving up today’s consumption in order to consume more later.”

Where does the return / gain come from?

It can come from three different sources, as explained below, where we will use examples to illustrate the given point:

1. Cash flow / Direct Income

Example #1: When you invest in a company’s shares, you actually become one of its shareholders.

As incredible as it is, when you buy an Apple share, for example, you’ll be a part-owner of the company, even if you’re going to own only a fraction of the shares issued.

From the profits generated by Apple, you, as a co-owner, receive dividends on your shares every quarter.

Example #2: If you invest in a property and rent it out, you’ll get a monthly wage fee in return, in the form of the rent you receive from your paying tenants.

2. Capital gains

The prices of both shares and property can rise, from which you can achieve capital gains.

Example: If Apple performs well, the price per share will increase. Let’s assume you bought an Apple stock for $100, which later increased to $150. In this case, you would have made a total capital gain of $50.

3. Cash flow + Capital gains

For many investments, you can get your returns from both sources. In the case of shares, you can receive dividends (although not all companies will pay dividends) and capital gains.

In the case of real estate investment, in addition to the monthly wage fee, the price of your property may also increase.

Investing Means Buying Income-Generating Assets

It’s no coincidence that we highlighted “income-generating” assets above. Colloquialism and the media often misuse investment as a concept.

For example, you may often hear people remarking that they have invested in a new car or a new phone.

For these purchases to be considered an investment, we must ask the following question:

Is this ‘XYZ item’ going to produce any future returns?

If the answer is no, then the new purchase is not an investment at all but instead is known as an ‘obligation’. This is because it may incur maintenance costs, but in turn won’t subsidise the user for these costs in any way, meaning they will be out of pocket.

Another thing to consider in this case is that the item’s value is also constantly depreciating (falling).

As we have said, buying a car for personal use is not an investment; it is a cost. But this can be changed if, for example, you were to start a courier company from which the vehicle will become a means for you to earn from.

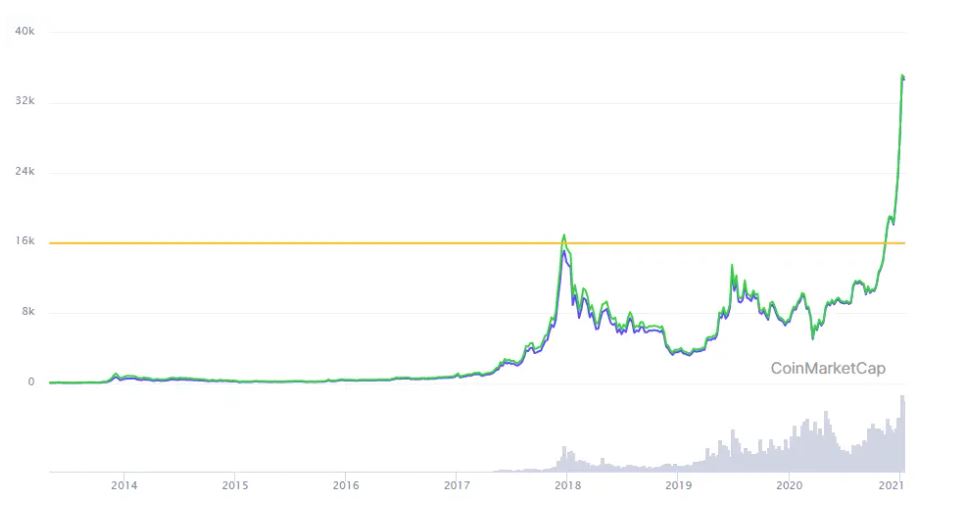

Contrary to popular belief, trading, Forex and cryptocurrency purchases aren’t actually considered to be investments. Instead, these are officially known as speculations.

The Difference Between Investing and Speculation

Despite there being critical differences between these two concepts, it can be difficult for beginners to distinguish between the two, this is also true for those who are more experienced.

According to the world-renowned investor, Philip Carret:

“The man who bought United States Steel in 1915 for $60 to profit from the sale at a higher price is a speculator. In contrast, the gentleman who bought American Telephone to get a dividend yield of more than 8% is the investor.”

Carret also, quite concisely, said the following:

“Speculation is the purchase and sale of securities or commodities merely in the hope of profiting from their exchange rate fluctuations.”

As one of the greatest investors of all time, Warren Buffett’s example reflects the difference between speculation and investment:

“There are two types of devices that can be purchased. One is where the asset itself generates returns for you, such as rental properties, shares, or a farm. And then there are devices that you buy in the hope that later someone will pay more for them, but the devices themselves will not produce anything for you. I think the second is speculation.”

Our take-away from this is an investor thinks in the long-term and buys an asset because of its future cash flow. Here the assets primary purpose is to keep your invested capital safe while achieving adequate returns simultaneously.

Opposite to this, a speculator buys a particular asset merely in the hope that its price will increase (or fall) due to market sentiment, regardless of whether the fundamental value of the underlying asset has changed.

Investor Vs. Speculator

The most critical differences between investment and speculation are the level of risk exposure and the certainty of retaining any invested capital.

In this case, the investor is more assured that they will not lose their money, whereas the speculator should know that there is a high probability that the investment can be lost entirely.

The problem is when a person believes they’re investing when they’re speculating, possibly causing some unexpected losses.

So, why would people speculate when they know the probability of loss is high?

The answer to this could be for the same reason that many people like to gamble – some may think speculation is exciting due to the, sometimes high-stake, risk, and that investments are boring in comparison.

To clarify, there is no issue with speculation, should you wish to put some of your capital here, but we must make the point that, if you wish to build wealth, then this might not be the best way to go about it (at least until you gain some market experience dealing with risk).

The best, most safe and proven way to build wealth for a beginner may be to invest.

In the world of personal finance, the general consensus is to never speculate more than 5% of your total wealth.

Why?

In the event that you lose everything that has a high-risk probability, it won’t have a big impact on your financial situation due to your other portfolio assets.

Why is it important to invest?

Since investments also involve certain risks, from time to time the question of whether it is really worth investing in the first place may arise. And, it may also be asked if there is a better alternative? Let’s look into this:

Why is it not enough to save?

Saving is the number one and most important element in achieving your financial goals, but without investing you won’t get much out of your money, depending on a number of variables.

The purchasing power of the amount held in fiat currency (Liquid cash) and that held in a bank account, is steadily decreasing due to inflation.

Many people don’t realise this fact. For example, if you set aside $10,000 today and don’t touch it, you will likely still see the same amount in your bank account in 20 years. The problem in this is that, due to inflation, in 20 years this amount will carry much less purchasing power. Meaning its value has steadily decreased throughout the years.

By investing, however, you can maintain the purchasing power of your money against inflation and increase it at the same time.

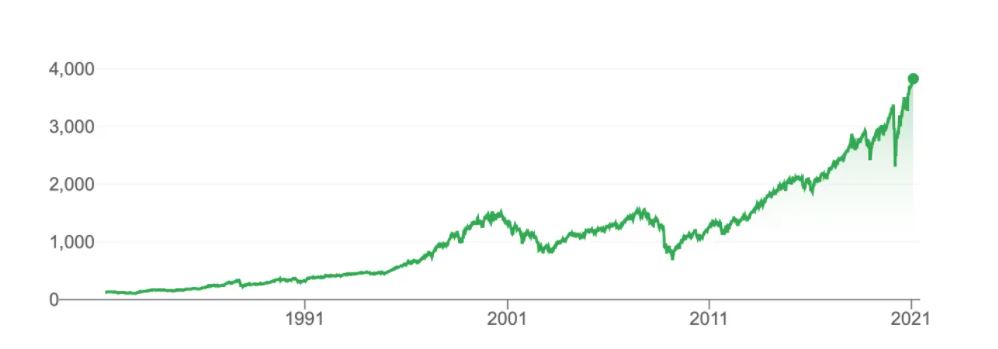

This is well reflected in the chart below, which shows an inflation-adjusted value (Real value) of $1 held in various assets (e.g. stocks, bonds, gold or cash in dollars) between 1802 and 2012.

It is clear that if you invested in stocks, for example, your initial $1 investment increased to $1,029,045 (above inflation!).

Conversely, if you kept your money under your pillow (DOLLAR), the initial $1 dropped to 0.051 cents due to inflation.

So you didn’t do anything, and yet you lost — you couldn’t even keep the value of your money.

Therefore, to answer the question posed at the beginning of this section: yes, where investing does involve risk, the alternative is guaranteed loss.

Build Wealth With the Power of Interest Interest

If you want to build wealth, whatever the reasoning (e.g. providing a good pension, building passive income or achieving financial freedom) – investing is necessary for achieving this goal.

You can increase your money by buying income-generating assets. You can then use the funds generated by these assets to purchase further additional assets that will, in turn, generate even more money. You can even continue to reinvest earnings infinitely if you want to build the portfolio quicker than you would otherwise be able to do so.

As Ben Franklin said, “Money that money produces, produces money.”

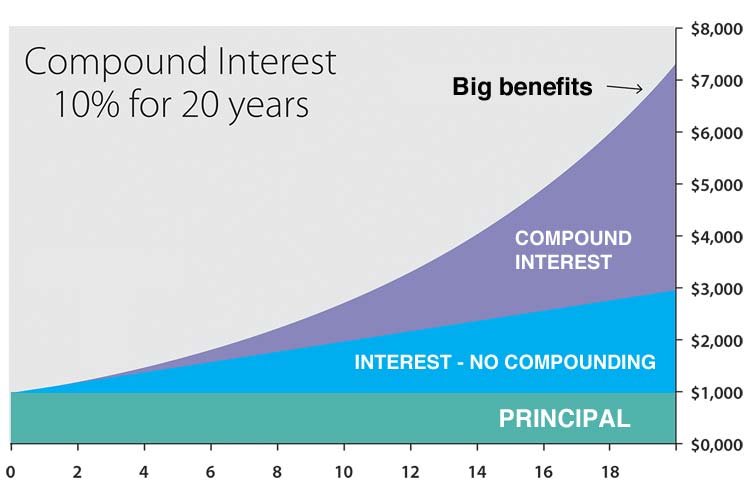

Thanks to compound interest, as you continue to reinvest earned capital, your wealth will begin to grow at an ever-accelerating rate.

Read more about compound interest and use our compound interest calculator to see how much return a month / year you can make. Click Here

The following illustrates the effect of interest rates:

As you can see, over time, an increasing and larger portion of your wealth is made up of yield (part marked in purple).

By the end of the 20 years, your total wealth was about $7000, of which you only invested about $1000.

When should you start investing?

This Chinese proverb. Although it has its own applications, it is very much true for investments too:

“The best time to start planting a tree was 20 years ago. The second best time is today.”

Why is this relevant?

The earlier you start investing, the longer you can utilise the power of interest rates.

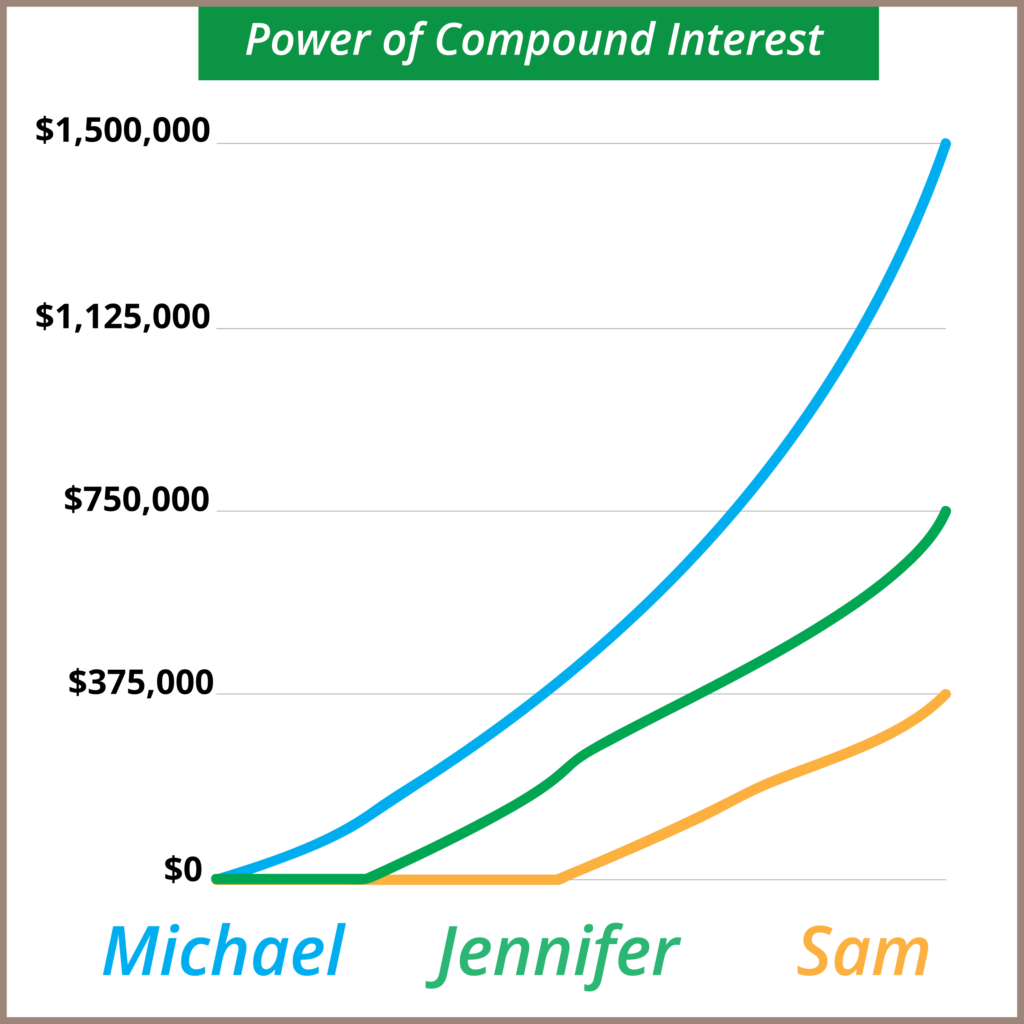

Let’s make three examples; Michael, Jennifer and Sam.

Michael started investing $95 a month at the age of 25, for 40 years until he was 65.

Jennifer began her investments 10 years later, depositing around $126 per month, for 30 years until she was 65 years old.

Sam discovered the investments very late, meaning he only started investing at the age of 45. Because she was so far behind the others, she decided to double Michael’s monthly deposit, so Sam invested $190 a month for 20 years until she was 65.

So all three invested, on average, the same amount – that is, $45,600 – all across different time horizons.

The question is, who made more?

Let’s look at:

Even though all three investors allocated the same amount over time, Michael was the one who ended up with the most considerable capital.

He enjoyed the power of compound interest for the longest time, so even though Jennifer and Sam invested the same amount, Michael’s money worked harder than the other invested capital amounts.

Why? Take a look at our Compound interest calculator here to see how it works for yourself!

Misconceptions about investing

Many people have certain misconceptions that will stop them from getting started altogether. So let’s begin this section by dispelling the most common misconceptions you may encounter.

Myth 1: Investing Is Difficult Or Complicated

Sometimes, the financial sector may try to overcomplicate investments in the hope that clients will be overwhelmed with all the information and will, therefore, need to make use of their advisory services.

The truth is that with just the most basic knowledge, investments become quite simple; You can acquire the basic knowledge required for it with just a few hours of learning.

Investing will always seem complicated when you don’t understand it in one way or another. But unfortunately, this is just a natural part of human psychology where a lack of understanding will be confusing.

Myth 2: The ‘Luck’ of Investing

Many people don’t invest because they have wrongly learned that investing is just the same as, if not similar to, gambling. However, certain assets, such as cryptocurrencies, do happen to be a little closer to gambling when we compare the levels of risk, which usually creates this misconception.

So what separates investment from gambling? There are many ways in which these two topics differ from each other, although here are the main three distinguishing factors of investing:

- With your investments, you have control over the level of risk exposure, and you can also limit your level of loss. Unfortunately, in the case of gambling, you don’t necessarily have the luxury of controlling these factors, meaning you can only win or lose everything.

- When you invest, you essentially become the owner of that particular asset, for example owning real estate or becoming a part-owner in a listed company (stocks). When gambling, you don’t own anything once you have assigned your capital to it.

- Before investing in any particular product, there will usually be a lot of information (often decades-worth) that you can first analyse to make reasonable and informed decisions. On the other hand, gambling will often not be able to offer this opportunity beforehand

Myth 3: It Takes a Lot of Money to Invest

Depending on the paltform, you can start investing from $10 today, so this misconception is also silly.

Moreover, you can use even smaller amounts of money to build significant wealth in the long run, thanks to the power of compound interest.

However, the important thing is that you start at the earliest moment you feel ready. With this method, you can gain invaluable investor experience with smaller capital mounts, meaning you can keep overall losses to a minimum in the long term.

These experiences will come in handy later in your investment journey when you have more capital at your disposal and start to invest more. If you’re not sure why using this method is helpful, the fact is you will make mistakes when you first start. However, learning from these instances, which produce more minor losses, and being able to apply the experience gained in future situations means you will be better prepared for more considerable risk exposure much quicker.

Myth 4: Only The Rich and Professionals Can Invest

Many people believe that only the more privileged of people can invest. This couldn’t be further from the truth.

Even if this was once true, practically anyone could invest in today’s market. We can say this is regardless of age, income or professional knowledge. And as we previously stated, it can be more beneficial in the long run to you, as an investor, to begin your portfolio with smaller capital amounts.

The Investment Funds

This section will look at the most important basics that you need to know about investments.

1. The Main Asset Classes

There are many investment options. We can classify almost all of these options into a corresponding asset class; An asset class is a group of financial instruments with similar characteristics.

A) Cash and cash substitutes (cash, T-bills, savings accounts)

This is the more simple of the groups, with the lowest risk management requirement. The primary advantage of such investments is high liquidity (immediately available or easy to convert into cash), with a maturity of up to 1 year.

Cash and bank deposits are included here, as are securities such as the Treasury-Bill (T-Bill) issued by the U.S. state, which is internationally recognised and often used as a risk-free interest rate.

B) Fixed income (bonds, government securities, bond ETFs)

It is an investment in debt securities. These are known as fixed incomes because securities offer investors a fixed interest payment within a specified period.

Fixed income is usually simply referred to as “bonds.”

C) Equity (shares, mutual funds, equity ETFs)

The term ‘equity’ derives from the fact that shares are equity securities. By investing in listed companies, we – in turn – become part-owners (or shareholders) of that company.

Through something called an ‘Exchange Traded Fund’, otherwise known as an

ETF, we can acquire shareholdings in a pre-prepared selection of companies at once instead of deciding what companies to allocate our money to one at a time.

An example of a more popular, and more importantly, proven ETF would be the S&P 500, the US index.

D) Alternative investments

As other financial instruments are commonly referred to as “alternative investments”, Real Estate; Commodities; Forex, Hedge Funds, Private Equity, and Derivatives are included in this asset class.

2. The Correlation between Return On Investment (ROI) and Risk Exposure

One of the main principles of investment is that return and risk go hand in hand.

This means that investment opportunities offering higher returns are associated with higher risk at the same time.

In the same way, low-yield investments offer greater certainty because of their low risk.

The following chart shows the yield-risk relationship between investment opportunities within different asset classes:

Both bonds and stocks are good examples of the point that we are trying to make here.

The risk of shares is higher than that of bonds. This is due to the fact that shareholders have what are called “residual claims”. This means that when it comes to any profits a company makes, creditors are paid first and then the shareholders. Meaning that, if the company is profitable, a policyholder’s returns are guaranteed, whereas those expected by a shareholder aren’t so certainly ascertained.

Further to this, in the event that the company goes bankrupt and is liquidated, the creditors’ claims are first satisfied from the assets sold and only after this has been done – and shareholders will only be paid if there is anything left.

Meaning when the liquidation of a company does unfortunately happen, shareholders often get nothing.

As referenced earlier in this section, because shareholders take on higher risk, they also expect higher returns in return.

In another example, government securities have a lower risk against corporate bonds, since the security of our capital depends on a state’s ability to repay us, compared to this companies carry more risk.

Of course, there are exceptions to this. An Apple bond is much safer than, say, a Ugandan government bond. This is because smaller countries carry more risk.

High Yield, Low Risk?

A recurring question you may sometimes hear, or even ask yourself is; “How can I get a high return with low-risk exposure?”

Unfortunately, there isn’t such a thing, at this moment in time, that can be utilised.

If there were, it would be an arbitrage situation that investors would understandably take advantage of very quickly and so it would disappear in the blink of an eye.

For example, imagine an extreme situation in which the yield of an almost risk-free government bond is higher than the yield of a stock, which carries a much higher risk;

Institutional investors (whose thousands of employees and computer algorithms constantly monitor the market) would immediately start buying government securities, as it has become quite attractive compared to other investment opportunities. This would increase the demand for government securities and therefore the price.

A higher price would simultaneously mean a lower yield, thus correcting the yield on government securities to the point where it reflects its risk.

So if you want to get a high return, you have to take a higher risk.

3. Diversification

While the risk of investing cannot be completely eradicated, it can be reduced by avoiding unnecessary risk.

You may have heard the saying, “Don’t put all your eggs in one basket.” This is very relevant here.

Many people make the mistake of investing all their money in one particular company’s shares. If you were to do this, and something happened to your chosen company, you could lose a lot of money or even potentially lose all of your invested money.

Think in Portfolio

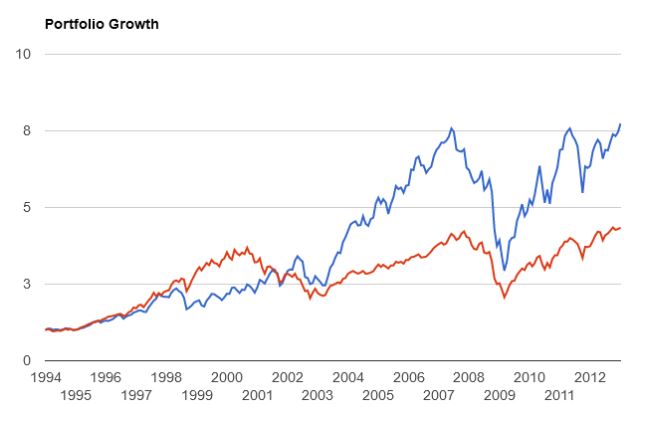

Instead of individual stocks or bonds, you may want to consider a portfolio that is more broad and diversify your investments across different asset classes.

This will make the performance of your portfolio less dependent on the performance of a single asset class, which will:

- Reduce the risk of your investments

- Increase the return on your entire portfolio

- With a well-diversified portfolio, you can achieve a much more favourable return-to-risk ratio.

As we have already seen, each asset class has its own unique feature and they each have an individual reaction to different market changes.

In general, where one asset class performs poorly, another will moderate or offset it.

Example: In times of crisis, when stocks tend to fall sharply, bonds can provide security, thus balancing the performance of your portfolio.

Not only should you just diversify between asset classes, but it would be beneficial to at least consider diversifying the products bought from within the same asset class.

Example: Instead of just one company, you can invest in many multiples, allowing you to spread your risk a lot more.

As you can see, you can diversify on three levels:

- Between asset classes

- Within asset class between different, individual investments

- Between different regions and industries

ETFs: One of the Best Tools for Diversification

The following question is a great one, not to mention reasonable to ask:

“I don’t have the money to buy hundreds of shares. In fact, I don’t have the time or knowledge to properly manage them. What should I do?”

There is a saying about finding a needle in a haystack. There is also a continuation to it which says, “Instead of looking for the needle in the haystack, buy the whole haystack instead”

With ETFs you can buy the whole haystack, figuratively speaking anyway.

With a single purchase you can buy into hundreds or even thousands of shares for any amount you can put aside. Minimum amount can vary platform by platform on eToro you can start investing from $10

Investment Concept: Summary

We’ve all heard that we should invest, but many people don’t start. Many are held back by the potential investment risks.

Investments can be risky, but if you invest according to a well thought out investment strategy, you can reduce these risks and have a fairly higher degree of certainty that you won’t lose as much as someone who doesn’t have a set strategy.

Don’t forget because of inflation, if you don’t invest, you are guaranteed to experience some form of a loss.

So therefore investing remains the most beneficial way to achieve your long-term financial goals of building wealth.

While investing may seem complicated at first, with proper research, it will surely become a lot more simplistic and can show good returns.

Have you invested before? Or perhaps you are currently studying and plan to invest in the future?

Whichever situation you are in, we hope that we have been able to cut the jargon for you by clarifying the truths of investing.

Please understand that NO information in this article should be considered investment advice and should only be used as a guideline.