Often referred to as silly money, dumb money is in reference to the average investor managing the investment steps of their own portfolio’s capital. A well-known platitude of the stock market is your average investor buying high and selling low. It is because of this trend that, at the peak of the stock market rise, the average investor portfolio holds a high number of shares. The question here would be;

“is there a link between dumb money and the future profit of the equity market?”

In this article, we will discuss how to track a portfolio’s level of equity exposure, as well as studies that have examined the reliability of this correlation trend. Household equity shares.

The topics covered in this article are:

- What does dumb money do in the stock market?

- Why is household equity exposure important?

- The relationship between household equity exposure and future returns

What does dumb money do in the stock market?

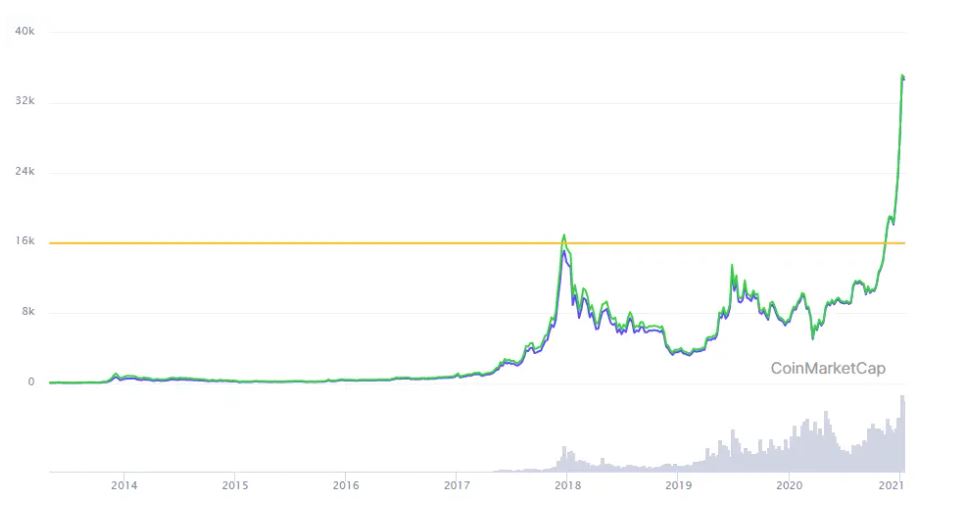

Dumb money indicators are often referred to as ‘mom & pop’ indicators, referencing the fact that the average investor invests their money generally uninformed, are less skilled, and are generally more likely to make more irrational decisions. It is only named this because, if we have enough skill to know how to read and apply the indicators that are most relevant to our portfolio, we can more easily – and more accurately – make market predictions for the future. Practically, it is based on this principle of households, housewives, methods of following silly money. To follow the steps of housewives, you can use several different indicators.

The most well-known of these indicators are:

- Dumb Money Stock Confidence Index

- Equity / Money Market Asset Ratio

- Retail Money Market Ratio

- NYSE Available Cash Interpretation

- AIM indicator

- Rydex Ratio

- AAII Investor Sentiment Index

- Households equity exposure

From those shown in this list, the AAII may be a popular topic but it doesn’t get all of the airtime. Another prevalent indicator from this list would be Household Equity Exposure, which we discuss in the following section of this article.

What makes household equity exposure important?

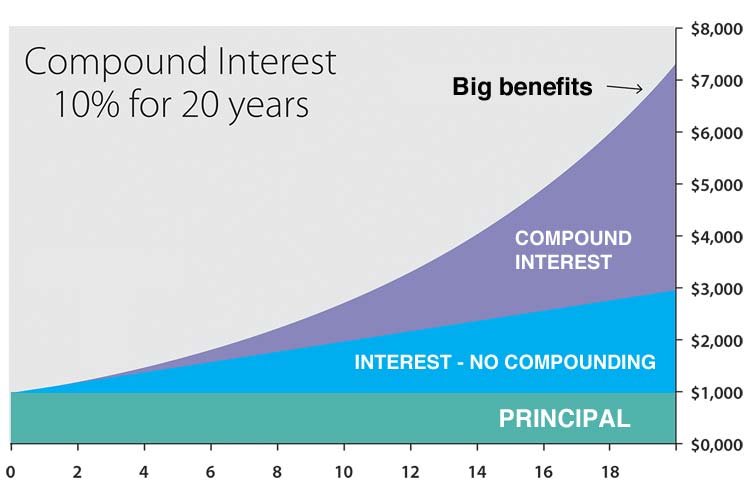

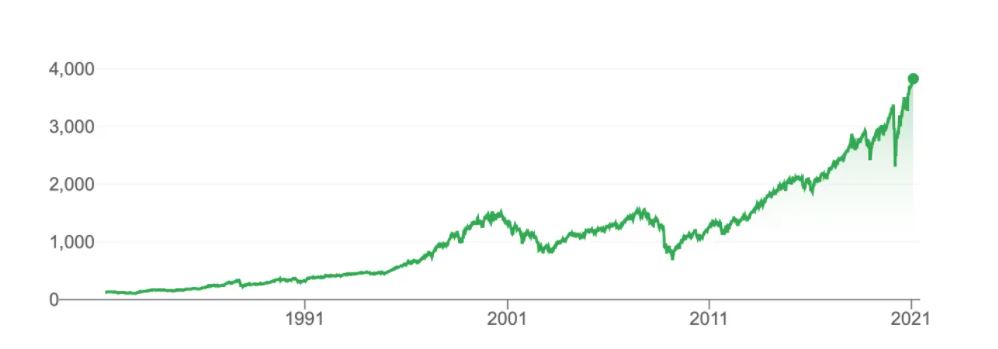

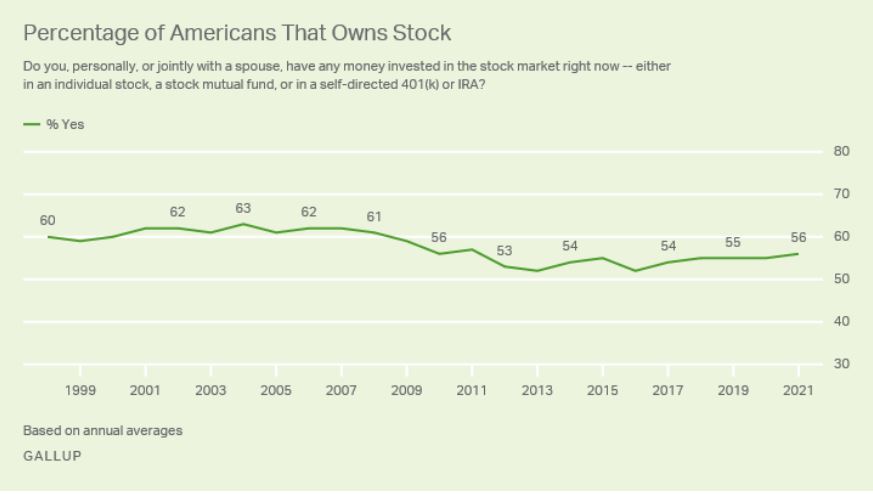

In recent years, there have been regular reports in the economic media (You can see those reports here, here and here) that U.S. households hold a record ratio of shares. When we say record ratio we mean that these households collectively hold at least 40 per cent of relative investment vehicle shares.

In the image below, we can – in a slightly more credible/comprehensive way than the articles quoted above – track the ratio of the value of shares held by U.S. households to all investment vehicles. Furthermore, according to this, 40% of US household assets are currently in equities. News has shown us the index had a higher value even before previous economic crises, an extraordinary situation that hasn’t been witnessed since Second World War.

Anyone who has noticed that, even before major crises (see 2008 crisis, 2001 dotcom bubble), the value of the indicator peaked (see red arrows), it committed a bias in retrospectives.

In hindsight, it’s easy to mark the tops because we can have a good understanding of where they may lie in the future. However, if we couldn’t loosely predict the future, we wouldn’t be so confident since, for example, in the three years before the dotcom bubble, household equity exposure was at a historic high (above 30%), and the collapse didn’t happen for another 3 years. Therefore, it is possible to show with significantly more accurate statistical studies than visual inspection whether there is any link between the equity exposure of households and the future returns of stock exchanges.

Let’s look at the details of this further.

The relationship between household equity exposure and future market returns

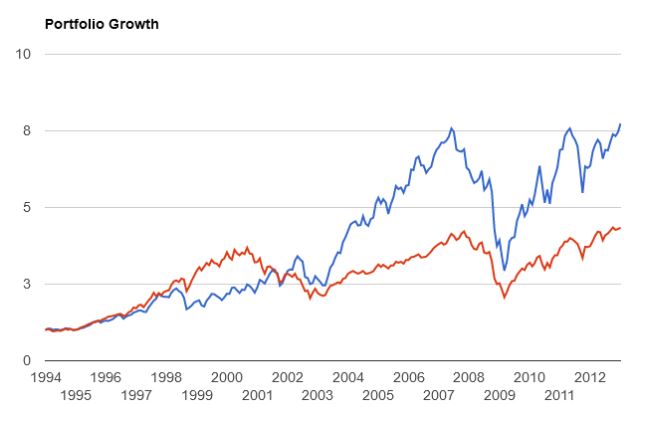

The research, published under the title The Household Equity Share and Expected Market Returns, specifically looked at whether there was any correlation between household equity exposure and future return on the stock market spanning the period of 1953 to 2015.

To carry out the study, the household equity share (HEShare) indicator was created, which shows how household equity exposure changes over a given period of time compared to money market instruments. According to this, Household Equity shares varies from 0 to 1, where for value 0, 0% of household wealth is in shares and 100% in financial assets.

At the other extreme (A Household Equity shares value of 1), household equity is entirely in shares and no financial assets are held. Of course, as we have learnt that the fluctuation of equity exposure lies between 55-80%, we cannot show these extreme values in reality.

When looking at the history of the Household Equity shares indicator, particularly over the period of 1950-2015, we can easily gain great insight. Immediately we can observe that this indicator fluctuated between 55-80%. Meanwhile the corresponding chart of the FED (Federal Reserve) only shows a fluctuation of 10-40%. The reason for the difference is that the Household Equity shares indicator looks at the ratio of shares, strictly that of financial assets, and the FED’s chart shows the ratio of shares to all investment vehicles.

How to follow the Household Equity shares indicator?

There are multiple factors that are attributed to this indicator, which make it such a great tool for all.

Let’s take a look at the main elements of the indicator in the section below.

Household Equity Shares Interpretation

Household Equity shares represents all shares held by households, which is the sum of shares directly owned by households and shares purchased through investment funds. The exact data can be found in the FRED (Federal Reserve Economic Data) database and in the federalreserve.gov database:

- Direct shares, under the name FL153064105.Q

- The value of shares purchased through investment funds under the name FL153064245.Q.

Household Credit Assets Interpretation

Household Credit Assets represent the financial assets of households, which is the sum of three data sources:

- Article FL154022005 Q – mortgage bonds

- FL154023005. Q – bank deposits

- FL153064235. Q – bonds

The above data can be obtained from the FRED and federalreserve.gov database.

In summary, the research discussed did in fact find a correlation between household equity exposure and future returns on the stock market. According to this, if household equity exposure increases, then the 5-year future return on the stock market can be expected to be lower.

It is important to see that this indicator does not have the capacity to time the market in the short term, it’s task is to predict the future yield of 5 years. But don’t forget, even though it predicts with a high reliability at this level, it is not infallible and can potentially be incorrect. There wasn’t always a close relationship between Household Equity shares and the yield for the next 5 years, this was particularly true in the 1980s.

Further to this, the correlation of Household Equity shares also in fact coincides with other correlations as well.

Of these, the correlation coefficient with, quite popular, CAPE is 0.4, which assumes a medium linear relationship (explanation of the correlation coefficient here). In fact, this means that in addition to CAPE, the role of the Household Equity shares indicator can also be a strengthening one.

Learn more about investing