October 31st is an illustrious date for Bitcoin believers, as it was on this day that Satoshi Nakamoto published the Bitcoin white paper, which essentially marked the birth of the leading cryptocurrency. We’ve gathered a wealth of information you need to know about Bitcoin, its birth and the last 13 years.

OUR BITCOIN SUMMARY;

TABLE OF CONTENTS

- About Bitcoin in brief

- How does Bitcoin and the blockchain work?

- 51% Attack, i.e. Weaknesses in the blockchain?

- Satoshi Nakamoto and the birth of Bitcoin

- Bitcoin’s highlights from the past 13 years

- Bitcoin; Purchasing and storage

- What do you need to know about Bitcoin and cryptocurrency mining?

- So, how green is Bitcoin mining now?

- What does ‘DEFI’ mean?

- How do NFTs work?

- El Salvador is an ambassador for Bitcoin!

ABOUT BITCOIN IN BRIEF!

Bitcoin can also be seen as a digital currency created as a demand for the modern age. In essence, it is an electronic money that can be transferred independently of national borders and can be held without restrictions, which is safely available 24 hours a day.

On 26.10.2020, 88,857 Bitcoins were transferred using a single transaction with a value of $11.5 billion (at that time), all with a transaction cost of just $3.54.

Unlike “fiat” money issued by nations, it is an important feature that it exists and operates without central bank involvement. It runs on a distributed network, maintained by thousands of computers around the world, they are the miners of certain. Bitcoin is actually the world’s first truly open financial network run by a predefined program code. In other words, users rely on the rules of exact mathematics and programming instead of politicians.

Bitcoin’s most important innovation lies not only in the development of an efficient payment system it invented, but also in the creation of a completely new industry. The leading digital currency uses blockchain technology that can be used for a variety of tasks other than payment. Blockchain records and validates all transactions and ensures network integrity. These transactions are grouped as a system of linked blocks, which thus create blockchain.

So Bitcoin enables fast, transparent and inexpensive transactions in a decentralized, centralized way with the help of blockchain technology.

Bitcoin is seen by many not only as a simple currency, but as a value-for-money investment that has made fabulous returns over a decade. Indeed, the predetermined characteristics of the programme in the code are significantly positioned as an alternative to gold. Many refer to Bitcoin as “digital gold.”

HOW DOES BITCOIN AND THE BLOCKCHAIN WORK?

Blockchain technology is often compared to the Internet and it may not even be foreseeable how it will transform our future world. Just as you weren’t sure what the future was like when you created a simple Internet protocol. We also had no idea that over time it would spread to our daily lives. Bitcoin, as the digital currency of the modern world, is one of the most well-known and perhaps easiest forms of implementation of Blockchain technology.

Blockchain is a digitally shared ledger of information, unique copies of which can be found in all nodes of the blockchain system. In blocks, we may store any information that is the sum of a transfer, the address of the recipient and sender in the case of Bitcoin, for example. All participants in the system can check previous transactions and add new ones. Transactions are arranged in blocks because of ease of processing, and these blocks are chained together. This is the blockchain name.

The relationship between the contents of the blocks and each block is protected by the cryptographic tool. This guarantees that the transactions carried out are irreversible and indestructible. In this way, you can create a ledger and transaction network where no third party is required to complete the transaction. This brings us to one of the most important features of the blockchain system: decentralisation.

The decentralised nature of the system not only ensures that no intermediary is needed, but also records transactions in a way that is transparent to anyone. This is the guarantee that the stored data will be irrevocable. The data is linked as links and cannot be changed retroactively. After all, the integrity of the system would be compromised in relation to the block that follows.

51% ATTACK, I.E. WEAKNESSES IN THE BLOCKCHAIN?

However, in the case of Bitcoin, we cannot only talk about benefits. Shared data, information stability, decentralised characteristics and transparency are all groundbreaking advantages, but there are potential disadvantages. This could be the possibility of a risk factor called a 51% attack, which is highly unlikely due to the size of bitcoin’s network, but it may be feasible for smaller projects.

There may also be a problem with a hosting issue. Finally, the immutability of the data must also be mentioned here. It has already been mentioned as an advantage, but in some cases it can also be a disadvantage. For example, if you mistakenly send Bitcoin to the wrong address, there is no one who can undo or compensate for it. At the same time, the areas of use of the technology are quite wide. We can see examples in the fields of logistics, health, financial sector, IT and even education – examples can be classified indefinitely.

SATOSHI NAKAMOTO, AND THE BIRTH OF BITCOIN

With regard to Bitcoin, the question may legitimately arise as to how it was created and who might be behind it. There are many mysteries and legends associated with the creation of Bitcoin, but it is certain that after a little research, the name of Satoshi Nakamoto will be mentioned. It is widely believed that Satoshi Nakamoto’s name is likely an alias – otherwise known as a made-up name. Satoshi means “wise” in Japanese, and nakamoto is a common family name, one meaning “origin.” And you don’t have to be a linguist to read the “origin of wisdom” composition in the context of bitcoin.

In fact, no matter what the motivation of the unknown programmer was to create Bitcoin, he certainly didn’t want to reveal his identity. With this fact, Satoshi Nakamoto says that the idea of the “product” is important, not the identity of the creator or programmer. Over the past 13 years, it has been suggested that he may be the mystery developer, but in the end we could appreciate the desire of those individuals to come into the limelight rather than reality.

Satoshi Nakamoto, by his own admission, started working on the bitcoin protocol in 2007. On 31 October 2008, he published a white paper on the operation of the electronic cash system, and on 3 January 2009 Nakamoto mined the first genesis block to launch the bitcoin network.

To date, it hasn’t been revealed who the mysterious creator of Bitcoin was.

Satoshi Nakamoto worked on coding himself until 2011, before disappearing completely from the world’s eyes in April. At the same time, he handed over the work he started to Gavin Andresen and the Bitcoin development community that has since emerged. Although not much is known about Nakamoto himself, his emails with programmers suggest his eccentric character.

László Hanyecz, a Programmer of Hungarian descent, also worked with Nakamoto. However, they never met in person, but based on their email exchanges, he is portrayed as a rather strange figure. According to László, there was something strange about working together and in the person of Nakamoto. He was bossy when there wasn’t an official working relationship between them. On the one hand, he seemed to be part of the development team in terms of work, but he consistently did not reveal anything about his personal side. He rigidly refused to do so and didn’t even answer questions about it, almost patiently guarding his incognito status.

However, given Bitcoin’s future and the main purpose of the project, this was understandable and certainly necessary. Bitcoin might not exist today if Satoshi hadn’t kept so much secrecy about the foundations of the system.

BITCOIN’S HIGHLIGHTS FROM THE PAST 13 YEARS

2008:

- September: the U.S. bank known as Lehman Brothers goes bankrupt, resulting in a global crisis;

- October 31st: The white paper of a new decentralised currency, Bitcoin, is published.

2009:

- January 3rd: The Bitcoin blockchain is started with the creation of the Genesis block;

- January 12th: The first Bitcoin transaction (from Satoshi Nakamoto to Hal Finney) was completed;

- October 12th: The first exchange rate was set, this was 1 dollar = 1309.03 BTC.

2010:

- 22 May: Hungarian born László Hanyecz is the first person to buy a product for Bitcoin; a $25 pizza for 10,000 BTCs;

- July: Mt. Gox, which was created as a collectible trading card game, became Bitcoin’s first stock exchange at $7:06 per BTC;

- October 28th: the first short transaction was made;

- November 1st: Bitcoin’s capitalization value exceeded $1 million and the price of 1 BTC had reached 50 cents.

2011:

- February 9th: The cost of one BTC token continues to grow, now reaching a 1-2-1 rate (1 BTC = $1);

- February 14th: Adoption of Bitcoin slowly begins to develop further and a used car is offered at sale for 3000 BTC;

- March 27th: It is now possible to trade Bitcoin for not only USD but now also GBP;

- April 16th: TIME magazine writes an article about Bitcoin;

- June: The Wikileaks platform becomes one of first organizations to accept Bitcoin donations

- July 22nd: the first Bitcoin app is published for iPad.

2012:

- March 1st: The biggest theft in Bitcoin history happens early, with almost 50,000 BTC being stolen.

2013:

- February 28th: The exchange rate reached a new high of 31.91 USD/BTC;

- March 28th: The total value of Bitcoins market capital exceeded 1 billion USD;

- April 1: BTCs exchange price exceeds $100 per token (1 BTC = $100>).

2014:

- February 28th: Mt. Gox, the largest stock exchange at that time, fails

2017:

- June: BTC exchange rate reaches $3,000 (1 BTC = $3000);

- August: Bitcoin cash from BTC fork;

- October: BTC exchange rate reaches $6,000 (1 BTC = $6000)

- November: BTC exchange rate reached $10,000 (1 BTC = $10,000);

- December: BTC reaches a peak of $19,783 for the first time (1 BTC = $19,783).

2018:

- Twitter CEO Jack Dorsey predicts that Bitcoin would grow to be bigger than the US dollar and will become the world’s primary currency.

- October; China and South Korea are the first states to restrict or even ban bitcoin trading altogether

2020:

- More and more institutional investors have put their savings into Bitcoin

- In Maj, the new Bitcoin halving has taken place. From 12.5 Bitcoins to 6.25 Bitcoins, block rewards are reduced

- Competitive thanks to the widespread spread of the digital currency (PayPal, Revolut, etc.).

- Bitcoin’s price has also broken its previous peak of $20,000 and ends 2020 at a record high of $29,110

2021:

- April 14th: BTC’s price has set a new high of $64,800;

- May 19th: BTC’s price plummets to $30,000, thanks in part to news that Tesla is selling its Bitcoin stock

- June 4th: The world’s largest Bitcoin conference is held in Miami, here El Salvador President Nayib Bukele announces his country plans to soon recognize Bitcoin as legal tender;

- September 7th: In El Salvador, in addition to the dollar, Bitcoin is finally accepted as legal tender;

- October 19th: The first Bitcoin ETF appears on the New York Stock Exchange

- October 20th: BTC’s price has set a new all-time high of $66,974.

BITCOIN; PURCHASING AND STORAGE

Especially during the bull market period, in the case of a parabolically rising exchange rate, many people ask where I can buy cryptocurrency and what to do with it. Fortunately, the answers to these questions are now considerably simpler than it was 13 years ago when the White Paper was first published. Since then, we have been able to buy Bitcoin for cash almost anywhere in the world. This can be presented with the help of a special ATM located in several parts of the world. And the process is just like using your favorite ATM. Only in this case will the bitcoin you purchased get to your previously created wallet through a QR code.

A more favorable way to buy is to do so through an exchange.

One of the most well-known and safest is Binance, but some other big names include Coinbase, Bitstamp, OKEx and Kraken or Crypto.com. In these cases, we can buy Bitcoin either by bank transfer or by credit card purchase. The latter is a faster, but mostly more costly, solution. Some exchanges accept PayPal or you can buy cryptocurrency with Paypal itself.

STORING OUR DIGITAL CURRENCIES

The other extremely important question is where to keep the cryptocurrency that you have purchased. If we bought it on the stock market, it is perfectly reasonable to store it there for certain periods. However, if someone isn’t actively trade these tokens, it isn’t recommended to keep them on the stock exchange for a long time. Even with market leaders users have fallen victim to hackers, or a stock market provider has simply been shut down. Therefore, it is recommended to store the purchased Bitcoin, or other cryptocurrency, in a suitable individual wallet.

Essentially, the crypto wallet is intended to connect the user to the blockchain through it. They don’t actually store money, they just keep information and thus provide a means to receive the cryptocurrency. This information includes public and private keys. The portfolio therefore contains an address that is an alphanumeric identifier, generated from public and private keys. Money can be sent to this address, but the money does not actually remain on the blockchain, it is only transferred from one address to another.

There are several types of crypto wallets based on these. Hot wallets are connected to the Internet and cold wallets aren’t, these “Offline” wallets are obviously significantly safer. But wallets can be software on your computer or smartphone, or it could be a wallet with a piece of paper. The point is, in the case that we buy, we are responsible for our own safe storage. It is important to note that the only way our money will actually be ours is if we also control the private key.

WHAT YOU NEED TO KNOW ABOUT BITCOIN AND CRYPTOCURRENCY MINING?

Cryptocurrency mining is the process by which transactions between users are checked and added to the public ledger of the blockchain. The task of the mining process is to introduce new coins into the stock that is already in circulation. A network of distributed computers and mining allows cryptocurrencies to function as peer-to-peer decentralized networks without the central control of a third party.

That is, miners operate transactions on the network of cryptocurrencies and verify their authenticity. To do this, they solve complicated mathematical tasks with the help of their machines, in exchange for which they receive digital currency, this is known as block closure. To do this, they provide strong computer hardware and energy supply, in exchange for which they receive digital currency (Bitcoin, Ethereum, etc.).

BITCOIN MINING THEN AND NOW

In the beginning, it was enough to have a traditional laptop or an average computer with which bitcoin (BTC) could be mined. Due to the low competition between miners at that time, the computer’s processor was used to solve the operations. Nowadays, however, the level of difficulty has increased so much that it requires some much more serious hardware. If you have more powerful computers, the more digital currencies you can get. Therefore, in countless parts of the world, huge mining farms have been created, whose function is to specifically specialize in the mining of cryptocurrencies.

The cheaper someone can get their electricity supply, the more profit they can make from cryptocurrency mining. For this very reason, mining activity is usually concentrated in areas where miners can get electricity cheaply. The combined resources of the many distributed computers ultimately make the Bitcoin network extremely secure. Because in order to cheat and manipulate mining, you would need to have more computers and power than all available resources combined.

Mining capacity has already grown to such an all-time high that it is now almost impossible to be able to achieve such levels of personal resource. Another beauty of the matter is that the otherwise huge energy consumption is covered by renewable energy sources due to efficiency and higher profits. Nevertheless, there are many attacks on Bitcoin mining questioning the extent of how environmentally friendly it is.

SO, HOW GREEN IS BITCOIN MINING NOW?

Higher energy consumption does not automatically mean that the user has a negative environmental impact, just as lower energy consumption is not necessarily environmentally friendly. With this in mind, the question isn’t how much energy should be used to run and operate the system, but instead what is the source from which the energy comes from and how efficiently is it used. However, based on the importance of the mining activity as detailed above, the following relationship can be observed. Miners are in constant competition with each other, which in economic terms could mean perfect competition.

FIGHTING FOR COST-CUTTING

On this basis, everyone is looking for ways to gain a competitive advantage over others. There are basically three ways of doing this, and this leads us towards positive environmental impacts. One way to increase your profit is to increase the price of Bitcoin. However, this is not influenced by miners and does not represent a different competitive advantage for individual miners.

The other solution is to use and develop more efficient tools. This is partly due to physical constraints, as development is slowing down today. Increasing the number of transistors in chips is becoming more difficult and costly over time, and thus the rate of development of more efficient devices is slowing down. Technically speaking, the only solution is to use more efficient cooling solutions to reduce the power consumption of devices.

Because it is common for data center cooling to reach 30-40 percent of the total energy cost, there is a legitimate need to reduce power consumption in this way; for example, by moving to colder, more northern areas. The third option for a competitive advantage is to explore cheaper energy sources and operate the system on this basis. This is where environmentally friendly, renewable energy sources such as water, solar or wind power plants come into view.

It is clear from the past that the energy cost is what miners can save the most on, so in both the medium and long term they are definitely forced to constantly seek out and operate on cheaper solutions.

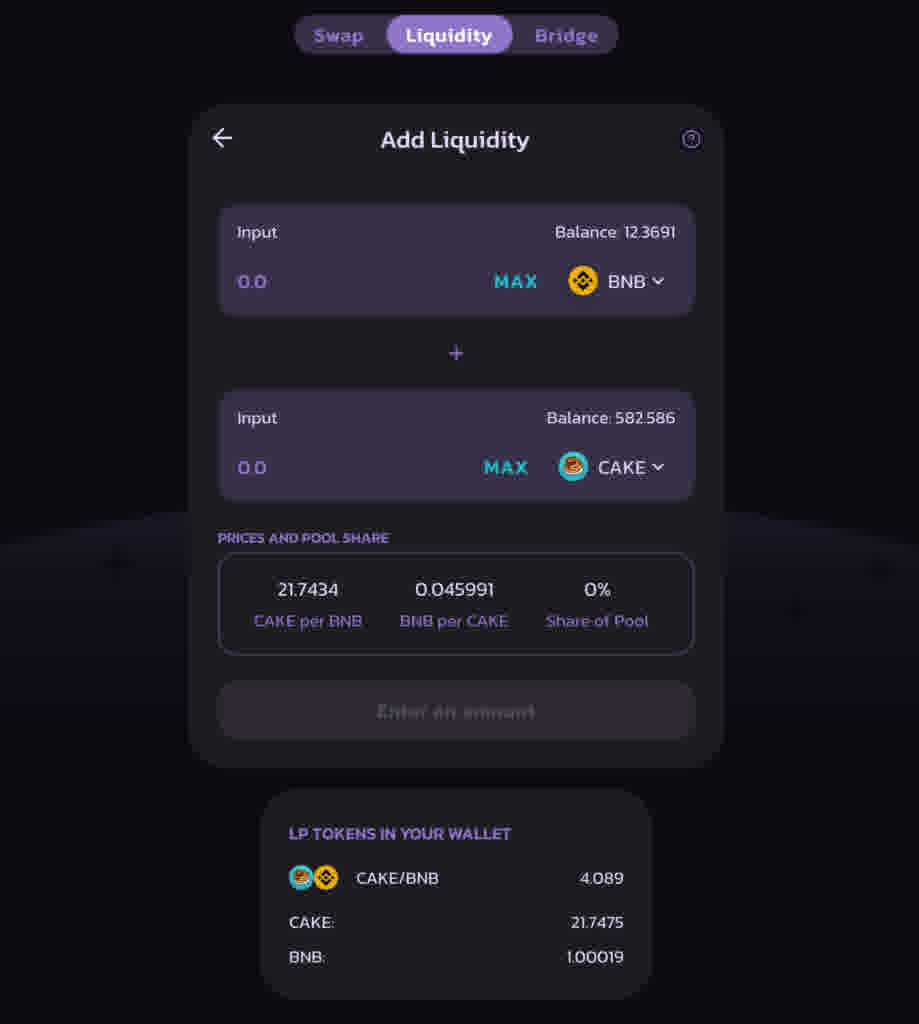

WHAT DOES ‘DEFI’ MEAN?

The simple answer to this question is that ‘DeFi’ is purely a broken down rendition of the term ‘decentralized finance’.

A more broad explanation to this would be that DeFi projects first exploded in 2020 and, in a sense, Bitcoin was also born from a DeFi project. The aim was not to have a centrally regulated financial system, but to work with the help of a decentralized, open source program. Decentralization means that there is no central manager, but instead the community resolves the important decisions together.

Today, DeFi is more about the opportunities offered by smart contracts than it is just about the meanings of the words. Smart contracts include, in addition to interest on deposits and borrowings, insurance, yield farming and decentralized exchanges. This list is actually almost endless and is constantly expanding from month to month.

BITCOIN AND ETHEREUM: THE BASICS OF DEFI

With the advent of Bitcoin, global money transfer became available without any central organization, company or government having a say in the movement and properties of money. This was not possible before, it was the first decentralised digital payment option.

A big fan of Bitcoin was Vitalik Buterin, who later created Ethereum in 2015. This attracted even more programmers, as many saw potential in it. The new network was programmable, smart contracts and decentralised applications (DApps) were created. DApps are essentially based on Ethereum’s network, consist of smart contracts and have a web user interface.

Decentralised financial services also require decentralised exchanges. Decentralized exchanges (DEXs) are online exchanges that allow users to exchange a particular currency for another cryptocurrency. DEX connects users directly, so they can trade cryptocurrencies without leaving their money to an intermediary.

WHAT DOES THE FUTURE OF DEFI HOLD?

The market capitalisation of the DeFi sector is currently somewhere around $157 billion, and its future has a lot to offer. Innovation is spreading rapidly, programmers are looking for opportunities every day, developing their software. Ethereum 2.0 will also have a positive impact on the market, with a faster, cheaper network and even more opportunities.

In the long term, DeFi can compete with the banking sector, the problem lies in the complexity of technology. It cannot reach a wide range of users for this reason, and the unregulated market is also a part of it.

WHAT GOOD IS NFT?

With the creation of Bitcoin, blockchain technology has taken practical meaning, and the natural result of its development is the discovering of new uses. In 2021, more attention was paid to Non-Fungible Tokens (NFTs), i.e. “Non-Replaceable Tokens”.

Digital products have existed before. You can send email, e-book, or mp3 files. However, the principle of digital scarcity could only be understood with the creation of Bitcoin. A product has been developed that, through blockchain technology, guarantees that the ownership of the data (money, works of art, etc.) sent from user A to user B will actually be transferred to the other user and that user A will no longer have any copies left. Moreover, this did not require a third party, as blockchain became the intermediary medium between the seller and the buyer.

The concept of NFT goes one step further than the above idea. While for cryptocurrencies tokens may have finite numbers (see BTC), all tokens are the same. Until then, for NFTs, each token is unique and finite in number. Naturally, this feature has stirred the imaginations of professionals in many sectors and is being experimented with in areas such as the toy industry, digital identity or even art. Due to the nature of the technology, it is even possible to buy a share in higher value works. Based on the above, NFT can be a fully digital device or even a digitized version of a physically existing product.

HOW DO NFTs WORK?

To answer this, let us first explain what ‘NFT’ means; this stands for Non-Fungible Token. In short, this can be broken down to mean something that cannot be officially replicated or replaced. When it comes comes the initial creation of NFTs, there are several operational frameworks that can define the creation and publishing of individual Non-Fungible Tokens.

One of the most popular is the ERC-721 standard which features on the Ethereum blockchain. It differs from ERC-20 standard in that each token is unique and non-substitutable as mentioned above. The ERC-1155 standard represents an improved framework in the same area. As a multi token standard, it is possible to place tokens that can be replaced and not substitutable in the same smart contract. This greatly facilitates the transmission of NFTs between different applications. Recently, in addition to Ethereum, Solana and Polygon have been providing technology funds to an increasing number of NFTs.

NFT tokens are becoming more and more popular in crypto communities. Prices are rising rapidly, with the most sought-after NFT collections selling for millions of dollars. Recently, the five largest NFT projects collectively generated more than $300 million in revenue. Like any unique work of art, NFTs usually carry cultural significance and social value. Another reason for NFTs becoming so popular is because returns made from the sale are paid directly to the respective creators. Not only this but creators can also continue to earn revenue from their works after the primary sale if they choose to apply creator royalties on their pieces.

EL SALVADOR IS AN AMBASSADOR FOR BITCOIN!

One of the most important milestones in Bitcoin’s history is likely to be 7th September 2021. Why you asking, this is because it was on this day that the digital currency became an accepted legal tender of a country for the first time in the world. Nayib Bukele, the president of the central American country El Salvador, announced his ambitious plans at the Bitcoin conference that was held in Miami in June 2021. In a prerecorded video, he said he would present to Congress a bill recognizing Bitcoin as legal tender in his country. The second half of the statement could hardly be understood by the rousing applause and ovation that ensued after.

NAYIB BUKELE, A BITCOIN BELIEVER?

The President of El Salvador has always been committed to becoming the first official country to have Bitcoin accepted as true currency. Although analysts and experts have warned the government that the move could lead to economic bankruptcy, the country’s first man was irrefutable. Among the benefits, he said, residents will have the opportunity to instantly switch their cryptocurrencies once Bitcoin is recognized as legal tender.

However, it was said in a statement on Twitter that 4.5 million adult citizens will have the opportunity to hold or withdraw cash (USD) from any of 200 ATMs placed around the country. According to the president, there will also be 50 accounts that can convert fiat currency into Bitcoin to keep residents’ savings in the cryptocurrency.

Presumably, apart from a few enthusiastic foreign journalists and a small number of locals, there is no mass demand to pay with Bitcoin yet. The Lightning Network, which handles payments, was also set up to speed up transactions. However, as the years go by, it looks like while the leading cryptocurrency may have become an excellent safe depository, it has remained limited in its ability to make everyday payments – even if Nakamoto’s original idea was to think of it as electronic money.

But if we think of El Salvador as a kind of “pilot country,” then the situation is certainly more than remarkable. There is no precedent for such widespread acceptance anywhere else and, in the very least, it will be a true example of how it works in practice. This will be likely to lead the whole sector to new innovative solutions. Either way, the country’s dedication and commitment to cryptocurrency is exemplary, for example it is true to say that 500 BTC were purchased in preparation for the mass release.

Read more from Us