Diversification is fundamental for sound investment portfolios. Yet, despite the importance of investment diversification, its meaning remains vague for many. When wealth building, it is important to strive to reduce the level of risk in your portfolio.

This article aims to aid your learning of how to begin minimising risk while your savings increase. Let’s get started!

What is diversification?

The essence of diversification is the reduction of losses by spreading the risk burden.

Let’s say you collect an amount of physical capital, and you now want to invest that money.

How do you go about investment diversification?

You read an article online that says how particularly well a technology company is doing at this moment in time. After reading the article, you decide to invest all of your money in shares of that single company. Then, when they release the quarterly report, it shows they never reached their projections, and the exchange rate starts falling sharply. Now roughly 40% of your invested capital is already absorbed, and you face losing everything, should the share price continue to plummet.

An alternative situation to the scenario mentioned above would be that you seek out some level of professional advisory.

Nine out of 10 experts are likely to recommend buying a bigger multiple of, preferably, different products instead of just several smaller ones that are all similar to eachother.

To create such a portfolio, for example, you would buy a smaller real estate unit, as well as government securities, bonds and shares. It would even be possible to further add more investment assets different to these ones. By building your portfolio like this, you would be able to spread the risk, therefore reducing how much is held in each asset. And if the value of one asset decreases (Like with the stock price we used as an example previously), then only a smaller portion of your entire wealth is lost, because only a small percentage loses its value. This is what diversification is.

You can read about the basics of investing here

Why is diversified investment important?

As we have said, the aim of diversification reducing the risk of investment. As long as you keep your total capital in only one investment vehicle, there is a chance that you will suffer a significant loss as a result of an unfortunate event.

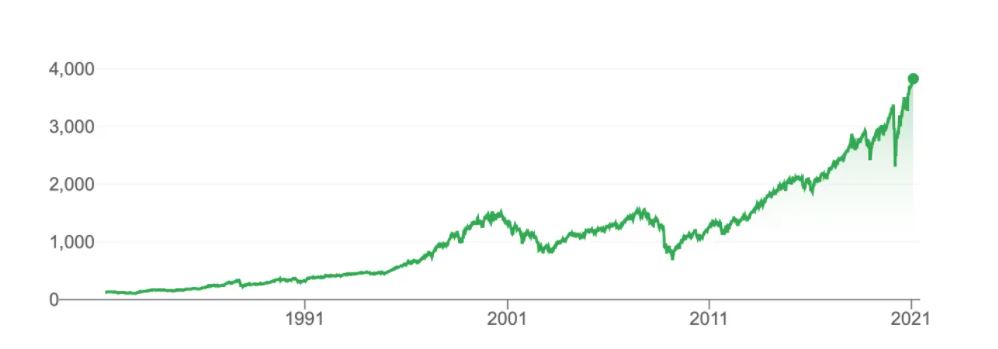

Economic processes are constantly changing and, therefore, so is the value of all the different assets. As a result, crises come and go – during which the value of various investment vehicles can fall significantly.

But on top of that, many things can affect their value. For example, a high-value property is still just a building and can become badly damaged (House fire) or even the quality of the property’s surrounding area, both of these reasons, and many more, can cause the property value to depreciate. Your money invested in the shares of an IT company could easily fall because of the scandal surrounding the company. And, further from this, your bonds can be devalued more or less overnight. Moreover, unfortunately, there have been cases in recent years when the issuing financial institution has become insolvent (not able to repay owed debts – bankrupt).

Read more about Why Depreciation Is The Biggest Perk Of Real Estate Investing

Although these examples seem to be extreme, over the last few years such stories could be read in credible news outlets. Unfortunately there will be more cases of this nature heppening in the likely not-too-distant future. Therefore it’s better not too underestimate the chance of such situations occurring.

In the case of a varied portfolio, usually only a small part of your assets will be in threat at any given time This makes having a diversified portfolio is moderately risk-reducing.

How does diversification work?

The most important rule of diversification is to invest in assets whose exchange rate movements don’t correlate. That is, the fall in the exchange rate of one asset class does not cause a negative change in the other.

Let’s say, hypothetically, you put 40% of your savings into an investment fund with high-risk technology stocks, and 60% into a low-risk sovereign debt or bond mutual fund. Thus, fluctuations in the price of high-risk stocks will not have such an impact on your overall savings.

By putting your money into mutual funds, you are diversifying on your own, because you are not putting everything on one company, but on, say, 60-70. So of course, here it is also worth carefully exploring the characteristics of the investment vehicle.

What should you pay attention to when building a diversified portfolio?

When developing a diversification strategy, think primarily about:

- What are individual goals?

- Do you want to invest regularly or in one lump sum?

- How much return do you expect?

- How long do you want to invest?

- How much risk are you willing to take?

Do you need a flexible, disbursable**, easy-to-monetize (liquid) form of investment from which you can quickly withdraw your money if necessary? Or do you have more of a long-term reserve that you won’t expect to touch for years?

Each investment vehicle has its own characteristics. The goal is not to have money everywhere, but to divide it into a percentage of different options, thus reducing the risk.

**able to be distributed or scattered – definition source here

Why is diversifying important?

In the world of investments, there is a rule of thumb: the risk taken is proportional to the level of return. So, on the other hand, a low-risk government bond will also give a low yield. But, due to the low risk of the government bond, the returns are more or less guaranteed. Exceptions to this would include; the bankruptcy of invested companies, war and economical collapse(recession).

A newly listed company with high expectations from investors promises high returns. However, bad political or economic news can be enough to cause a stock’s value to fall by 20-30%.

This shows that it is worth diversifying our investments primarily on the basis of risk levels. On a scale ranging from low-risk investments to extremely risky assets, you need to choose the forms you’d like to invest in. Of course, it is worth combining the different risk assets in certain proportions that are relevant to your overall strategy.

What major asset classes can you invest in?

Government securities

Government securities are one of the simplest, least risky forms of investment. When you buy government securities, you essentially “lend” your money to the state, that is, you get a state guarantee. Low risk is accompanied by low returns.

Bonds

A bond differs from government securities in that you don’t “lend” your assets to the state here. Instead, they’re “loaned” to a financial institution or company, and for a fixed period of time. The risk is higher here too since, in this case, it is more possible for a company or financial institution to become insolvent(unable to pay arrears in any case). In addition, the so-called exchange rate risk is to be taken into account, which is due to the change in the value of the given bond. The higher the yield on a bond, the riskier it is.

Shares

When you buy shares, you acquire a small slice of the ownership of a particular company. This investment vehicle is an extremely high-risk asset, which should only be considered if you have good market research, market experience or – if you are more inexperienced than most – are prepared to potentially experience losses within some of your trades.

Read about market risk here

Property

A real estate investment is one of the so-called illiquid investments. This means that it is difficult to exchange a property for cash. Buying and selling a property, or even renting it, takes longer, so if you need money quickly at any time, real estate is not the best way to invest your property. In the case of long-term financial plans, however, this is an excellent asset to have. For this type of investment, the risk is moderately high, but the time and capital requirements can be significant. – despite this, if you are renting your unit out, this will easily make a return for you as a more passive income.

Foreign currency

Foreign exchange investment is one of the most skilled investment vehicles, because of this the risk management required is high. This method isn’t recommended for beginners under any circumstances.

Read our article about Forex

Commodity products

In investment terminology, naturally occurring raw materials used in different industrial sectors are referred to as commodity products. Examples of commodities would be gold and oil. In addition to foreign exchange trading, this is the other group of investment assets that requires a higher level of expertise and large time expenditure and can be very risky.

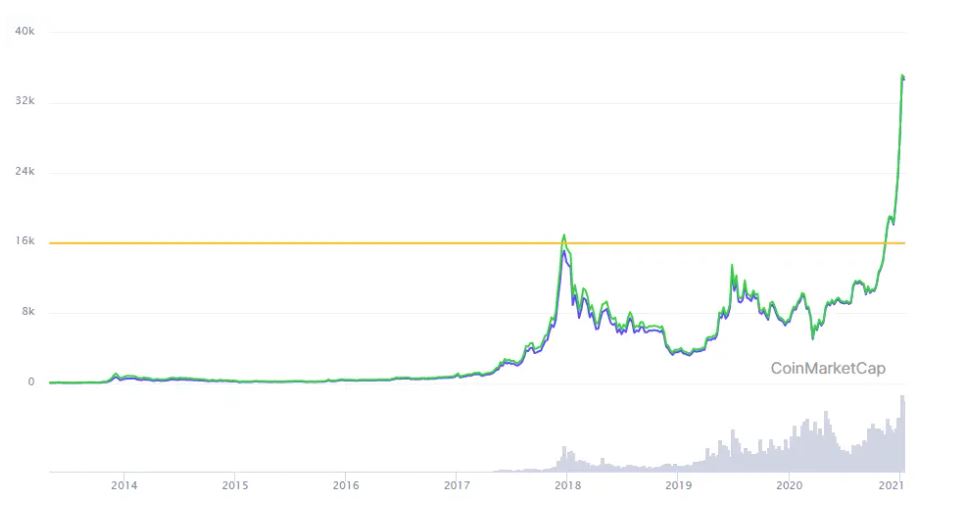

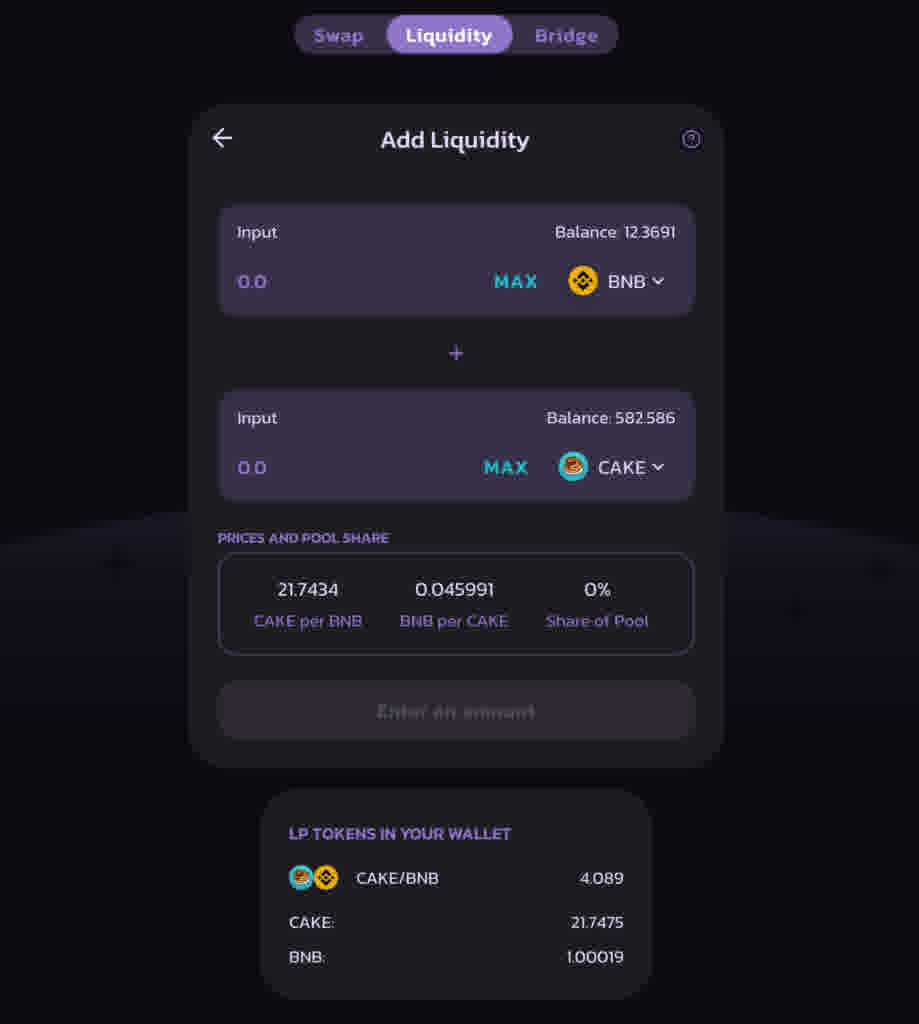

Cryptocurrency

Virtual money has recently become a very popular investment vehicle due to its return potential. Although it should be noted that there have been numerous instances of regular, unexpected crashes and unpredictable behaviour of cryptocurrencies that you can readily find information on.

Bearing all of the above in mind, cryptocurrency trading is a particularly risky area of expertise.

The easiest way to diversify investments?

The easiest way to diversify is through investment funds. The advantage of these is that by buying a single asset, you practically put your money in a diversified portfolio. For example, with a fund, you can choose an investment fund based on geographic regions (e.g. USA, Far East, Central Europe, etc.), raw materials (gold, oil), risk, or even sector. Each fund has dozens or even hundreds of securities, which also supports diversification.

In addition, this way you can diversify much more cost-efficiently than buying each of the securities, found in any chosen investment fund, separately. And further to the fact that these assets are completely liquid, a whole team of experts is engaged in achieving the best possible return on it.

Putting savings in investment funds can also be solved within the framework of your pension insurance in the form of life insurance tied to investment units

Is there such a thing as excessive diversification?

Diversification is very important in creating a balanced investment portfolio, but it can also be overdone. One of the disadvantages of excessive diversification is that the investment system can easily become overbearing for any investor. If you don’t know exactly what your money is doing and what or where losses have been made, and where to focus your attention, you may lose control of your money.

Another downside to excessive diversification is relatively low yields. Figuratively speaking, the more legs you stand on financially, likely there will be less capital allocated to each product. This is why, most of the time, these lower yields can be expected. Not only this but, lower capital allocation also means there is less risk of you losing a large proportion of investment in one go, without diversification you could even lose everything all at once.

However, this does also mean if one asset fund generates high returns, you will benefit less from it because of the smaller amount invested than if you put a larger amount into it.

This reduces the relative return on diversified portfolios, but in a balanced investment system, the strengthened portfolio security offsets this lower yield potential due to reduced risk, and therefore reduced losses.

Conclusion

As in other areas of life, it is very important to reduce the risk in finance and it can be detrimental to keep our savings and assets all in one place: whether it be in an account, in a bank account, or in the shares of one particular company. However, with a balanced portfolio of investments managed very carefully either by you or by experienced professionals, you can be sure that your wealth grows in the long term and provides you with financial security.