Binance Review, Binance is a cryptocurrency exchange that was founded in Hong Kong in 2017, and has rapidly grown into the world’s largest crypto exchange based on trading volume. The initial growth and popularity of the platform were so impressive that they had to temporarily suspend registrations in January 2018 so that they could keep up with demand. Today, it offers customers a highly well-established range of more than 40+ fiat currencies and 300+ cryptocurrencies with no deposit fees and highly competitive trading fees (up to 0.1%), all of this applies worldwide – where applicable.

The most important features and benefits of Binance

It has so many features that make it one of the most popular crypto exchanges in the world. Here’s a list of Binance’s best features:

- Extremely low 0.1% fees, with discounts if you pay with BNB;

- More than 300+ different cryptocurrencies for purchase, sale or trade;

- Android and iOS mobile apps are available;

- Advanced, classic and basic trading platforms to suit your needs

- Do more with Binance Earn – increase your crypto;

- Binance Visa Card – spend your cryptos anywhere with a card

- P2P exchange – trade directly with others on your own terms

- Binance Loan allows users to borrow crypto

- NFT marketplace for buying and selling NFTs

- Margin trading with leverage of up to 10x

- Futures and derivatives trading

What services does Binance offer?

If you’ve done some research on the best crypto exchanges, you’ve probably found that there are many options, making it difficult to decide which exchange platform to choose. With this in mind, we’ll help you work out the suitability of Binance by explaining the best services it has to offer to see if this is the right exchange for you.

More than 300+ different cryptocurrency purchases, sales or trades

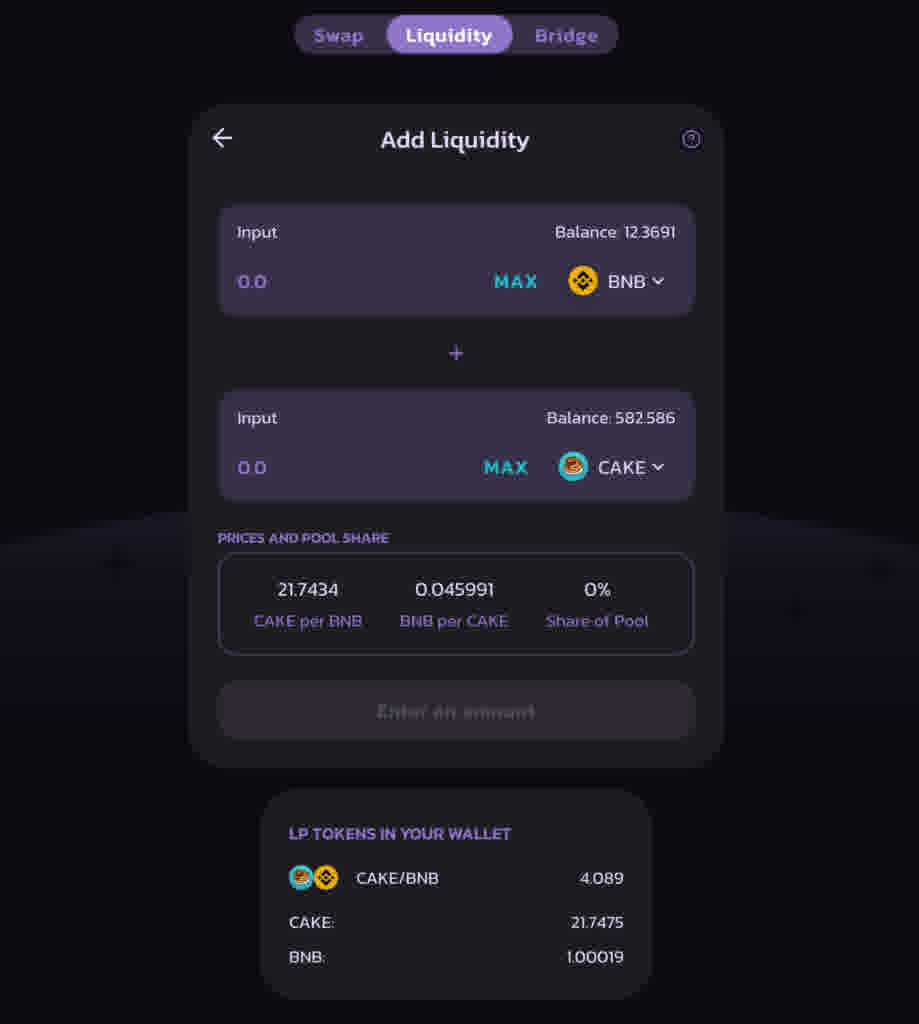

Binance offers over 300+ different cryptocurrencies, making it one of the most comprehensive offerings in the world. As the world’s largest cryptocurrency exchange based on trading volume, you know liquidity will be high, so you will be able to buy and sell (almost)any coin on their platform with ease. The native token here is Binance Coin (BNB).

Below are the latest figures:

Android and iOS mobile apps

Binance has an excellent application, making everything easy for beginners. The ease that this platform affords its users also suits advanced traders by simplifying processes. Within their corresponding app, there are two versions that you can switch between at the touch of a button, these are as follows:

There is Binance Lite, which is excellent for beginners, and Binance Pro, which gives you access to many advanced features and trading tools. Further to this, according to the Google Play store, the app has more than 10 million downloads, with a high user rating of 3.7/5 stars – This rating is based on 617,000 user reviews.

Advanced, classic and basic trading platforms

Binance serves customers of all levels, from complete beginners to experienced day traders in the crypto investing world. If you want the easiest way to buy crypto, you only need to select the basic “Convert” option, which creates a straightforward interface.

Those who are more comfortable with the traditional market interface can choose the Classic method of buying crypto, which has much more information than the basic version. Experienced traders who want full access to all trading instruments can choose the Advanced option under the Trade tab.

Use Binance Earn to grow your crypto portfolio

Binance offers users various options to increase their crypto while leaving it on the stock exchange. If you plan to hodl (withhold/hold onto) your crypto, this is a potential investment opportunity. Instead of it lying dormant as available funds in your portfolio, you can work with it. The following sections below, explain the different bidding options.

Binance Visa Card

Binance works with Visa to offer a card that lets you spend your crypto with 60 million merchants worldwide. In addition, the card is free, has no administration or processing fees, and you can even get up to 8% cash-back on eligible purchases! This is undoubtedly a significant step in the right direction to make crypto a mainstream payment method.

P2P Replacement

Binance offers a peer-to-peer exchange that allows users to trade cryptocurrency directly with each other between their portfolios, on their own terms – in virtually any country!

Binance Credit

Anyone registered as a Binance user can access a loan if they wish to take one out on the platform. There are several credit conditions that you can choose from when borrowing; It is possible to make an early repayment and pay only for borrowed hours. The interest rate is calculated at 0.001667% (0.04%/day) per hour.

NFT Marketplace

NFTs have taken the crypto world by storm and are continuously gaining popularity. Binance has seized the opportunity to take part in the movement. Binance has its own NFT marketplace, where NFTs can be minted, bought and sold.

Margin trading with leverage of up to 10x

Margin trading is only available for a select few trading pairs; further to this, with some trading pairs, users can acquire leverage as high as 10x. Cross margin trading can be hazardous as users risk their entire account, while isolated margin trading only poses a risk to that trading pair.

Futures and Derivatives Trading

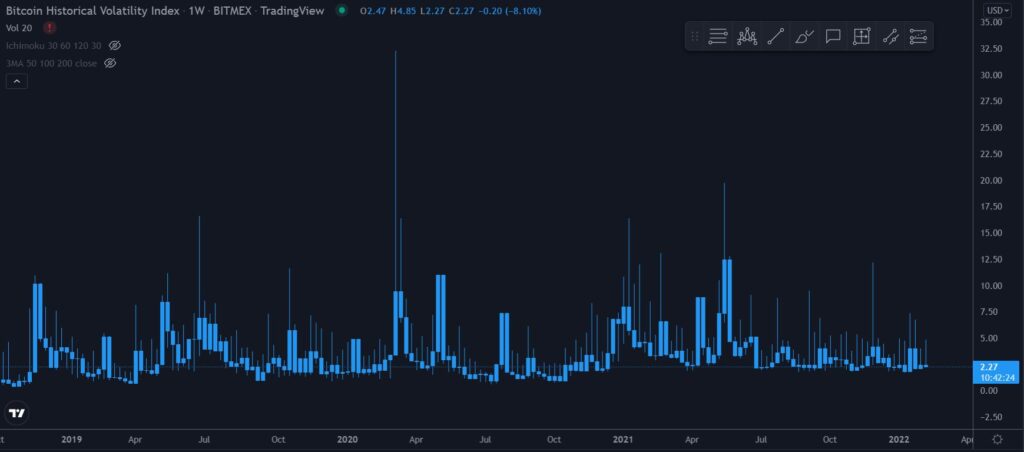

A relatively new feature is Binance Futures, which allows users to speculate on the price of Bitcoin and altcoins such as Ethereum, Ripple, Litecoin, Bitcoin Cash and others. When trading futures, users do not actually buy or sell cryptocurrencies, but only take advantage of the price rise/fall to make money.

The futures interface is very similar to the trading platform itself. The only difference is features, such as the ability to view open positions and features that allow traders to control leverage. Binance Futures fees are up 0.04% for each trade. Fees are lower for traders with a huge monthly trading volume or, subsequently, if their trades often increase liquidity in the order book before they are executed.

Binance awards

It has extremely low fees, and it is in fact possible for them to be reduced further.

Deposit fees

If you put cryptocurrency in Binance, there is a zero fee. If you deposit fiat currency into Binance, the fee will vary depending on how you deposit and the currency. For example, if you pay Australian dollars (AUD) using PayID/OSKO, it’s free. However, if you deposit Hong Kong dollars (HKD) by credit card, the fee is 3.50%.

Payment Fees

The withdrawal of cryptocurrency from the Binance account comes with a flat fee that covers the transaction costs of transferring crypto to the wallet. The fee varies depending on each coin. In the case of fiat currency withdrawals, the fee varies depending on the withdrawal method and currency. For example, taking the Australian dollar (AUD) by bank transfer is free. Paying the pound sterling (GBP) by credit card comes with a 1% fee.

Transaction Fees

Fees for spot trading (buying and selling cryptos) start at a low 0.1% and you can get a 25% discount if you pay the fees with Binance’s own coin (BNB). This means that you only pay 0.075% for each trade!

Trading Fees Compared to Other Popular Exchanges

Binance – 0.075%

KuCoin – 0.10%

Coinbase – 4.5%

Bybit – 0.10%

If you’re a large-scale trader and hold a lot of BNB tokens, you can reduce fees even further, with the lowest fees with a 0.015% maker fee and a 0.03% taker fee, including a 25% discount using BNB.

Binance security

As a platform, Binance is a secure cryptocurrency exchange that keeps most of its digital assets offline in cold storage and also gives its users tips on ways to increase security. In line with their strong security ethics, there are account settings to enable 2FA (two-factor authentication), the whitelisting of devices, payment address management, the enablement of anti-phishing codes, and even U2F (universal factor 2 authentication) – which requires physical access to hardware to access the account.

Despite all of these efforts to keep the exchange safe in 2019 Binance fell victim to a cybersecurity breach and lost more than $40 million worth of Bitcoin. However, they reacted commendably to the situation; The resulting losses were fully subsidised and so users did not suffer any actual losses. Four months after the incident, they received ISO 27001 certification after passing an audit of information security management. This shows how committed Binance actually are to maintaining a secure platform for all customers. Further to this, Binance is constantly investing in ways to improve their cybersecurity protection.

Summary

In the world of cryptocurrency, Binance is certainly a big and popular name, this is no accident. Based on trading volume, it is the largest crypto exchange with competitive fees and a platform designed for both novice investors and experienced traders. With over 300 different coin offerings and extra features like bets, margin trading, futures, and even an NFT marketplace, it’s an excellent platform to rely on for your blockchain activities.

Don’t have an account of your own? If you want to open one follow the link to get started:

Read more analysis from us here