Can I gain financial independence? How do I build wealth and get rich? These are questions that many people could potentially ask themselves at any stage in their lives. Unfortunately, it is not always possible to find a concrete answer to this that would apply to everyone in most cases. It’s hard to give a straight answer because there is no quick fix, and it isn’t enough to just dream of becoming a millionaire; there is a lot you may need to do to achieve financial independence.

In other words, it’s never too late to start building wealth, nor is it ever too late to start gaining your financial independence. However, we can’t escape the fact that you will have more time and more potential opportunities to build wealth and get rich if you’re from a younger demographic. Regardless of your age, though, the sooner you start to make changes, the sooner you will see results in your life.

Did you know?

The majority of lottery winners will, quite often, return to the same financial level that they were at before they won their jackpot prize.

This is largely to do with the fact that most people don’t have the knowledge that is necessary to keep and grow personal capital.

So, How do I build wealth and get rich?

1. Adapt your mentality

The first step to wealth is to change your way of thinking. If you do not have the right mentality, achieving your financial goals will be made that but m9re difficult for you.

If you find you look for different reasons for someone else’s success, yet you are always trying to find reasons for why you don’t have money, you will have a long way to go until you achieve the levelled mentality that is needed.

One of the biggest resources that any one of us can use to further ourselves in this field is reading books, especially those that focus on self-improvement and write about financial success.

Best Financial Books

These books are fairly inexpensive, no matter which way you look at it and they will tell you about different practices that will help you start working towards financial independence as well as how to achieve the ideal mindset for wealth building.

1 – Rich Dad Poor Dad, by Robert T. Kiyosaki

(Available on Kindle, Audiobook, paperback and MP3 CD)

2 – Think and Grow Rich, Original 1937 Edition, by Napoleon Hill

(Available on Kindle, Audiobook, Hardcover, Paperback and MP3 CD)

3 – The Intelligent Investor, by Benjamin Graham

(Available on Kindle, Audiobook, paperback and MP3 CD)

4 – The Richest Man in Babylon, by George S Clason

(Available on Audiobook and Paperback)

5 – The Total Money Makeover: A Proven Plan for Financial Fitness, by Dave Ramsey and Thomas Nelson

(Available on Kindle, Audiobook, Hardcover and Paperback)

6 – The Psychology of Money, by Morgan Housel, narrated by Chris Hill

(Available on Kindle, Audiobook, Hardcover and Paperback)

By reading these books you can learn many things, like how to get rid of debts, earn a passive income, and even how to better put away the money that you make.

2. Invest in yourself

This point is more of a continuation of our previous point. Investing in yourself requires you to spend time, and some money, on learning and self-improvement.

What does this involve?

- Reading

- Completing courses

- Refining your skills

- Building connections

Many people underestimate the importance of getting to know each other and building professional relationships. However, it should be more well-known that people with wealth are almost certainly guaranteed to have important business contacts now that the individual gained by building extremely valuable relationships during the early stages of their mission to build wealth and get rich.

The more skilled and experienced you are, the greater the opportunities you will have.

Your first goal in wealth building should be to strive for a wage raise or find a new job that you want to do and can earn more money in whilst being able to do something that you’re genuinely passionate about doing. Ensuring you are in a job role that you can be proud of and earns you more income will prove to be a solid starting point for you. From this, you can create a more robust financial basis for yourself, bringing your financial independence one step closer.

“The most important investment is to invest as much as possible in yourself.”

– Warren Buffett

3. Save

As we hinted at, at the beginning of the article, there is no such thing as an A-Z guide to getting rich. Still, there are good habits that you could consider that will undoubtedly significantly contribute to your future financial success.

Saving should be considered a main priority if you are looking to build wealth as, without doing it even a little a bit, it is almost impossible to begin to make a more considerable fortune.

You can start saving with small steps:

- Spend within your means and never more than what you expect to earn within any relevant time period.

- Set a portion of your income aside at the end of each month. If your pay schedule differs from the changeover of the month, do this when the pay cycle refreshes, and you receive your wage. A good level would be around 10% of each wage packet you receive, but only ever save what you can afford to.

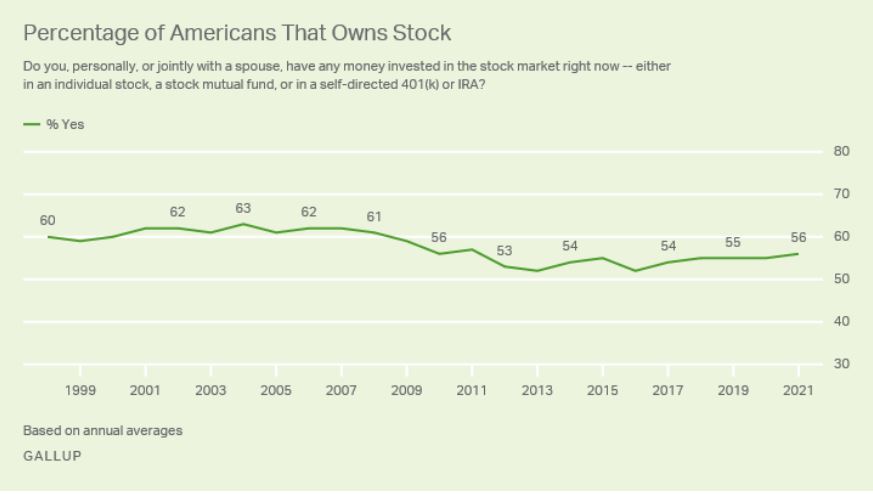

- Investing the money you save is a wise way to store your savings as, if the market is in your favour, it will be working for you instead of lying stagnant in an account. In addition, some stocks can even earn you dividends, meaning you will receive an extra return as a shareholder from the company at a specified time.

Although, because of market volatility and some unpredictability, f you’re inexperienced here, don’t take on too much and revisit this later in your journey, as at least some market knowledge and a lot of due diligence are necessary.

Properly managing your finances is the first step to financial independence. If you regularly spend on unnecessary things and end up being left with very little at the end of your pay period, you probably wouldn’t be able to keep your wealth growing progressively.

4. Create a budget

Creating a budget to summarise your income and outgoings can be very helpful if you struggle to see where you can start to build wealth.

Keeping track of your expenses and calculating how much you can comfortably spend each month may be more straightforward. You can easily do this with the help of a phone app or even computer programs such as Microsoft Excel.

You may be surprised at how you spend most of your money.

At the beginning of each pay period, determine how much money you will need in different areas of your life (bills, other direct debits, etc.) and set aside an affordable amount of money for savings every month, or pay cycle. This amount will form the basis for the construction of wealth.

—

Budgeting in 3 simple steps

Step 1 – Assess your income.

You can’t skip this step, and you must determine precisely how much revenue you have each month.

Step 2 – Determine your expenses.

Create different categories relevant to the different types of spending that you will do in a month, then calculate how much goes towards each category. Classifying outgoings like this will simplify everything to read easily on a page, furthering your ability to determine where you could make changes in your spending.

Step 3 – Calculate the amount you can save.

Suppose you cannot yet pledge a set percentage of your income to savings every pay period. Any money you don’t need to pay mandatory expenses should be put away – still ensure you will have money available to you in an emergency.

—

5. Create a plan

If you want to build wealth, you will need a plan and this isn’t just made up of the previously mentioned budget; it will help you a lot to achieve your goal.

With the help of a plan, you can think more specifically about the smaller details and, therefore, more carefully map out the necessary steps you will have to take during your journey.

Your budget and the steps in your plan will undoubtedly adapt and change over time, but if you have a visualised plan, you’ll have a better chance of reaching the goals, further motivating you whilst you work towards the end goal every day.

6. Consolidate any debts

It is important to get rid of all debt as soon as possible if you have any. In addition, if you have previously taken out a personal loan, home loan or other product, it is worth prepaying them as early as you can.

When creating a budget, you also need to consider loans as, until consolidated, they will be an ongoing cost.

If you don’t pay the instalments on time, you will lose even more money due to the rising loan caused by interest. So spend as little as possible and spend as much money as possible to repay the loan.

Debt settlement loan

A debt settlement loan can help you, especially if you need to pay off several loans simultaneously.

With the help of the current debt settlement loans, you can redeem your old high-interest loans and repay the amount at a more favourable interest rate.

We spoke a little more in-depth about the methods that you can use to settle debts, in our article here.

7. Surround yourself with the right people

If you want to be successful, it is important to invest time in quality friends who have goals like you.

It is also necessary to be able to talk to these people about things that will help you move forward, energise you with positive energy and give you strength in difficult times.

If you have friends who encourage you, this can be a great help in difficult moments and difficult decisions.

“Great people talk about ideas, ordinary people talk about things, and small people talk about other people.”

~ Eleanor Roosevelt

8. Invest in shares and real estate

Passive income is one of the best ways to make money. You would find that, if you asked them, almost every wealthy person would likely have investments that make them money, even while they are sleeping.

If your only income is through working, you essentially have to sell your time to make ends meet.

You don’t need a lot to start and could begin investing with very low capital amounts today. If you already have a significant amount of money and just want to build on it, you can even invest in real estate when the market is in a period of stability.

Best investments?

There are many forms of investment, so before making a choice, it would be a good idea to compare the yield and risk levels of different methods before choosing.

Financial Independence

9. Start your own business

Setting up a business of your own can sometimes be highly profitable. Although success here relies on several factors that you will need to consider – for example, are you offering people a valuable and useful product or service?

It is not easy to create a successful business, but if you are willing to put in enough time and work and can cover any initial investments you may need to make, you can certainly earn a great income level over time. It is a sure thing that hard work will bear fruit here.

Don’t put all of your eggs in one basket

In the beginning stages of building your business up, if possible, only work for it in your spare time and definitely only leave your current job if your company reaches a stage where it can easily provide you with a secure livelihood.

10. Take risks

–

It is important to preface this point by saying always pay due diligence and be sure to always stay within your financial means.

–

Don’t be too afraid to take risks. If you always air on the side of caution, at least too much anyway, you will find it is a difficult way to build wealth and get rich.

Those who live too comfortably and find it difficult to do anything outside of their comfort zone will not try new things, even those that have the potential to put them in a better position.

People who know how to build wealth and get rich will dare to take risks, try new things, and learn from the mistakes they have made.

Do you want to invest, but have you always been afraid to make the wrong decision? The internet is full of free courses to help you get started on the path of investing. It is important to not feel like spending on paid learning materials is a bad thing or like it will set you back; it won’t: these resources often contain information that will serve a much higher value for you in the future.

11. Think about variety

Even though risks can prove to be a good move and have a good payoff, it’s not the best decision to just focus on only one area.

Although over-diversification can be a bad thing, don’t just strive to be good at one thing, try to improve in as many ways as possible.

If you focus on just one thing and ignore everything else, you can potentially lose out on a lot of useful information and opportunities. This could cause a lot of harm to you and your potential finances in the long run.

For example, say you did set up a business – you invested all of your money into it and it became very successful. What if, after a while, your circumstances change and you no longer have time to serve the business but don’t want to employ staff? this could cause you to have to give the business up and you would financially have to start building all over again.

However, if you have gotten to a stage in your mission to build wealth that means you can confidently accept any potential losses, investing some of your money in real estate, stocks and shares, means that your risk exposure would be divided. This means that the successes you have would compensate for any loss you may experience in another area of your portfolio.

Our article here looks deeper into the subject of Diversification. It talks about topics such as why it is a good practice and the different types of available investment products. Also, it discusses the subject of over-diversification and the adverse effects this has on a portfolio.

Create more sources of income and always have an asset that will passively generate money for you – this should be the main goal as a successful passive income will take you leaps ahead.

Find new opportunities and try out more new things to try and further yourself. This increases your chances to get rich and build wealth successfully.

12. Don’t procrastinate

If you postpone everything, you will never achieve your goals or find it more difficult than you should. We understand it is easy to think you have plenty of time left or you will do a particular task “tomorrow”.

This way of thinking can be seen a lot in younger individuals. You think you will have plenty of time to achieve your goals.

Unfortunately, this mindset will help you to get nowhere fast. You may realise in 10 years that if you had taken that first step today, you would have been miles ahead from where you ended up and much closer to where you want to be at that stage.

Conclusion

In summary, wealth can only be achieved through developing useful habits and attributing yourself to proper, invested work. Try to spend less from month to month and, once you would able to financially recover from any potential loss without too much difficulty, invest a large amount of your savings to increase your money’s value.

If you know your financial goals already, in order to have more money later, it is always best to take the first steps today rather than waiting and putting it off until later.