Long-term investment: A “How to”

Generally speaking, long-term investment is usually a beneficial solution for those who want to increase their money and can spare the money for many years to come.

In general, long-term investments are more profitable than short-term investments. Although, on the other hand, it does still come at a price of its own. Long-term investment requires more experience on the part of the investor.

You shouldn’t rush your purchase, and the product should be carefully selected, as the yield will be influenced solely by the future of the product – This is why we always stand by the DYOR (Do Your Own Research) mentality.

Long-term or short-term investment, which to choose?

- Compare the best long- and short-term investments available on the market based on maturity, profit and risk.

- Decide which product is best for you.

Five principles of long-term investment

Before you begin investing, it is crucial to be aware of the aspects that will help you make the best decisions.

1. Choose an investment that will satisfy your goals

When you invest your money, you need to know how much risk you can take. You must select the product according to your own needs.

2. Invest in multiple products

The more products you buy, the more confident you can be that you won’t lose your money to a company. Diversification usually results in a lower risk.

3. Don’t try to time

Many people want to invest with the buy low and sell high strategy. However, such timing is risky and often gives experienced investors a hard time.

4. Shop as planned at regular intervals

Regular investment is a well-established technique. The basic concept is to divide the amount you want to invest into several parts and invest the capital at predetermined intervals.

Experience has shown that this technique makes it cheaper to obtain shares overall. This is known as dollar cost averaging

5. Check your investments

You should look at your portfolio at least once a month. The market is constantly changing, so the balance between your products can easily be upset. If you notice this, it is recommended that you redistribute the amount invested..

How can I invest?

There are many different ways a person can invest to shape and build their portfolio. However, as there are distinct differences between the available products, it can be overwhelming to choose which ones to allocate capital.

Here, we have put together short explanations of each product you will see most often:

Shares

Minimum capital: From $1 You can start even with a small amount as you can even buy just a fraction of a share

Possible profit: very high

Time horizon: 5+ years

Savvy: very high

Risk: very high

Stocks are one of the most popular types of investment. Many people buy shares because there is a large amount to choose from and everyone can likely find a suitable product for them. Stock investment can be beneficial in both the short term and the long term.

The biggest problem with securities like this is that they can be risky. Many factors influence the value of the shares. For example, the company could go bankrupt casing you to lose your entire investment.

If you decide to buy shares, we recommend you diversify by buying shares in several companies instead of just one.

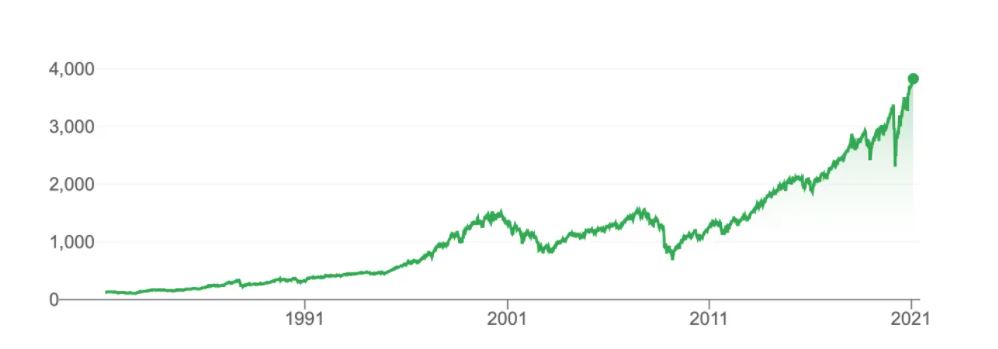

S&P 500 index growth from 1981 to 2021. This includes the value of the largest 500 companies in the United States.

Property

Minimum capital: over $100,000

Possible profit: high

Time horizon: 10+ years

Savvy: medium

Risk: medium

Real estate can be a profitable long-term investment. There will always be demand for it, so you can be sure that a property will likely hold its value in the future.

When buying real estate, it is worth considering several aspects. Your chances for success will likely be higher if you purchase real estate in a developing city, in a popular neighbourhood.

An apartment can potentially be a lucrative passive income when run correctly. Why – because if you rent it out, you can make a profit long-term, continuously, not just from a single, one-time sale.

Investment fund

Minimum capital: $1,000 to $10,000

Possible gain: medium

Time horizon: 1-5 years

Savvy: low

Risk: high

An investment fund can benefit people who want to save long-term but are less knowledgeable about the market.

Experienced investors manage this fund and will invest your money in different products. They get a small contribution from the profits but, in return, they help you put your money in the right places.

Anyone who buys into an investment fund can choose an open and closed-end contract. The open-ended contract can be sold at any time, but the closed-end fund can only be redeemed at the end of the term.

Risk:

Although experienced investors manage money for a living, they too can also make bad decisions. So, keep in mind that an investment fund is sometimes almost as risky as buying securities yourself.

Bitcoin

Minimum capital: From $1 You can start even with a small amount as you can even buy just a fraction of a Bitcoin called Satoshi

Possible profit: very high

Timescale: 1+ months

Savvy: very high

Risk: very high

Bitcoin was the first cryptocurrency and is considered to be the most popular. By design, it helps people to store their money in a secure, location separate from the bank in their own crypto currency wallet that only they have access to and no-one can control it but we will talk about this in a separate topic.

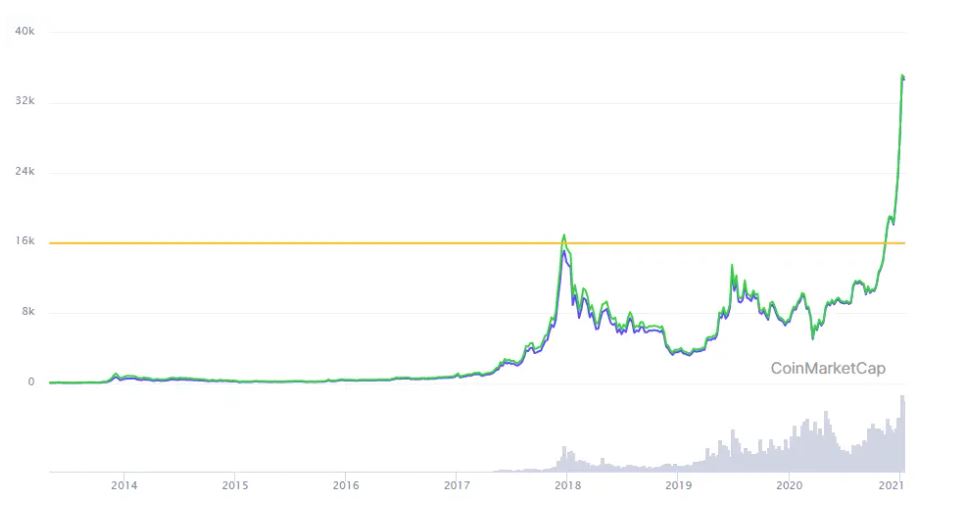

Because of its popularity, many investors choose to trade with Bitcoin, this is evident when looking at price increase patterns. Bitcoin is being adopted as a currency by more and more businesses, but the future of virtual currency is still not known.

Bitcoin has increased over the years. The price is expressed in US dollars (USD).

We only recommend cryptocurrency investing for individuals who have some experience and/or are aware of the risks involved.

ETF

Minimum capital: $1,000 to $10,000

Possible profit: high

Time horizon: 1-5 years

Savvy: low

Risk: medium

ETFs are exchange-traded investment funds. An ETF includes several securities, primarily shares of similar companies.

Because it invests in multiple products simultaneously, it is safer than a single stock, but it also has a lower yield. For this reason, shares are usually bought by those who think in the long term.

By purchasing an ETF, you would be investing in the product behind the investment fund. An ETF can be more than just a security; it can also be a commodity. Most ETFs are index trackers.

Commodities

Minimum capital: $1,000 to $10,000

Possible profit: very high

Time horizon: 5-10 years

Savvy: very high

Risk: very high

Many people think that some commodities products aren’t profitable. In contrast, various raw materials and essential products can be an excellent long-term investment.

There are several ways to invest in such products. The easiest way is to buy the goods or choose a suitable aforementioned ETF.

Risk:

In the case of commodities products, risk must be taken into account due to the government’s and economy’s heavy influence on the market.

Benefits of long-term investment

> In most cases this form of investment produces a positive return.

> The best weapon against recession.

> It can require little effort and little attention when ran well.

>You can use profits to reinvest back into the asset.

> Long-term yields will not be affected by temporary fluctuations.

Disadvantages of long-term investment

> It takes a lot of patience.

> It is more difficult to diversify than with short-term investments.

> It demands determination and commitment.

> It’s hard to know which investment would be worth it the most.

> To choose a good product, you need experience.

Pay attention to this in case of long-term investment

Before you decide to invest in the long term, you may want to be aware of a few things.

- Don’t have unrealistic expectations. Long-term investments only develop over time, so don’t expect an immediate return.

- Take the risk. Like all investments, long-term alternatives are risky.

- You need knowledge. It is not worth starting the investment hot-headedly, and long-term investments require both experience and strong research.

- Optimize your investment. If you’re thinking long-term, it’s worth keeping your money in more products.

Misconceptions

There are some misconceptions that novice investors often misjudge. We want to take the chance to correct some of these misconceptions for you, because:

- Shares do not always yield high returns in the long term

- Bonds can sometimes out-perform shares

- You don’t have to wait for the market’s “lows” to invest

- You may not benefit if you leave your money to experts

- Investment should not be based only on past returns

- The chance that you may lose the amount invested, indeed exists

Before you invest your money, consider the fact that this money will be written off and is ‘no longer yours’ and that this could last for years, or even decades. So never invest more than what you can afford.

If losing the amount invested would result in financial difficulties, you’ll probably have to reduce it. This also includes utilization of personal loans which, a lot of the time, is not a wise move in the long term – only invest if YOU can!

Before deciding, think about the worst-case scenario since, with this, you can assess your potential situation including any negative consequences, making a sensible decision easier to achieve.

Where and how can I invest?

- If you want to invest in real estate, you need to look for an apartment or house on the market.

- If you would like to invest into a bank deposit, contact your bank.

- If you were to buy a security or cryptocurrency, it is easiest to do this through an online broker.

If you are looking for such a platform, we recommend eToro to you. eToro is one of the most popular online brokers; their services are available both on mobile and PC.

Investing in eToro

Anyone can use eToro, and CopyTrading makes it an excellent choice for novice investors.

Registration takes a few minutes, but you will need to verify your identity after completing your user profile. To do this, you will need a scanned, document.

On the site you can choose from several products, such as:

- Shares

- cryptocurrencies

- ETFs

- CFDs

- Indexes

Once you’ve confirmed your user account and deposited into your account, you can purchase any product. The use of eToro is entirely free of charge and there are no hidden fees.

$100,000 demo account

Novice investors will receive a demo account. The preliminary account allows you to test the site and gives you some experience of the market. Making it easier to decide what product(s) you want to buy later with the demo account.

CopyTrading

CopyTrading is one of the most popular services on eToro. Here you are able to replicate the movements of a more experienced investor, gaining further insight into market strategy at the same time – all whilst hopefully making a profit when they make good decisions.

The risk must be taken into account

Successful investors also make bad decisions, so don’t expect CopyTrading to relieve you of the risk of investing.

Before choosing CopyTrading, be sure to check investors’ listings. Their profile contains valuable information, including how much their past investments have come out good.

eToro gives you every opportunity to make the right decision.

How do I create an account on eToro? – eToro

Synopsis

Long-term investment requires a lot of commitment, as well as patience, but more often than not this waiting will bear fruit. There are plenty of opportunities for long-term investment in the market; you just need to find the solution that suits you best.

Don’t forget the following:

If you’re a novice investor, try your luck with a smaller amount first.

Before investing long term, it is necessary to heavily consider what kind of product to buy and why any particular one would suit your portfolio.

If you decide to invest in something with a high risk factor, it would likely be a good idea to consult an expert before going ahead.

Only risk as much as you can comfortably lose.

Every investment is done at your own risk and past performance may not always be a reliable indicator of future results. It is never a certainty that an investment will pay off and so careful management is important.

Read more from Us