How To Make Money Work for You!

Table of Contents

- 1) What does it mean to make money work for you?

- 2) Interest Rate: The Eighth Wonder of the World

- 3) What we aren’t taught in school

- 4) The formula for wealth

- 5) Your house and your car are obligations

- 6) Focus on building income-generating assets

Have you ever wondered what it would be like if you got your current salary without having to work for it?

One of the very important pillars of my path to financial independence and my blog is this: take your money to work for you so you never have to work for the money again.

Money can work nonstop 24 hours a day, 365 days a year, on public holidays while you’re asleep while you’re on vacation.

Money will never rest, it will not go on holiday, but will always work faithfully and diligently for you and generate even more money.

Money’s busy!

I guess you can see what I’m trying to say…

I think it’s so important to understand this, I named my blog after that.

The goal of financial independence is to have your money working for you 100% instead of having to work for you.

If you get to the point where your money alone generates enough money, you will never again depend on your current job.

But if for some reason, you don’t care about financial independence, it’s still important to have your money worked, because, on the one hand, it means additional income to build a more secure future – I mean your retirement years, among other things – and on the other hand, under your pillow – or even in your bank account in the current interest rate environment – your money will be devalued.

What Does It Mean To ‘Make Money Work For You’?

The best way to answer this question is through an example.

For this example, we will assume that you have $3,200 (£2,339) to invest in shares.

The stocks will be valued at a price and will pay you a dividend. For simplicity, let’s say your annual return before inflation is 10% in the form of dividends.

This means that in a year overall you will have $3,520 (£2,572.90), that is, you have an absolute return of $320 (£233.90).

Basically, it took you a few clicks to make the initial investment, and your money then took care of itself. That’s what they mean when they say money works for you.

But what happens if you leave your money to work by itself for more than a year?

Interest Rate: The Eighth Wonder of the World

Continuing with the example above, let’s see what happens if we do not touch the $3,200 that we invested in equity for, let’s say… 30 years (calculated with an annual return of 10%):

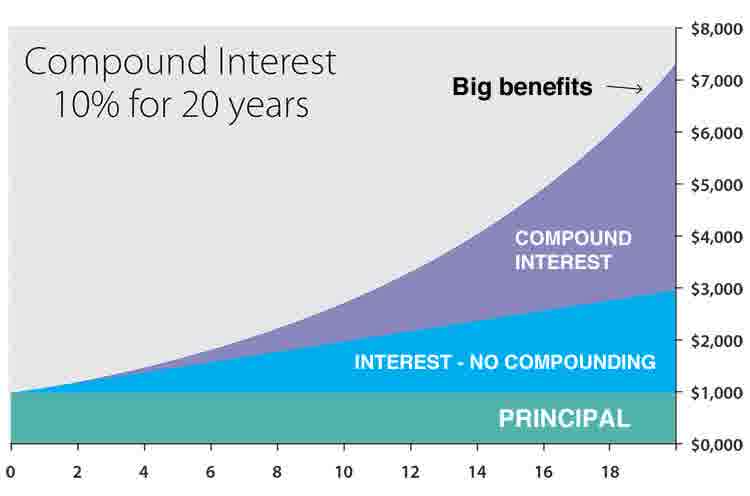

In the diagram above, you can see the power of your money if you let it go to work.

While in the first year you received only 10% of the $3,200, i.e $320. In the second year, that yield from the previous year will also generate additional money, so this time around you will get 10% of $3,520. This is called interest.

This continues for years as your money generates more and more profits. As your profits grow, your wealth grows at a consistently accelerated rate.

The perfect analogy for this would be to compare it to a snowball. As this snowball rolls down the side of a mountain, it picks up more snow and compacts itself, growing exponentially as it goes.

You will see that the $3,200 will become nearly $57,582 without you having to do practically anything!

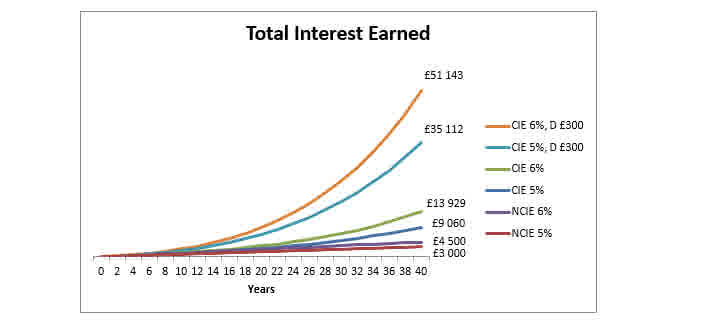

Now let’s look at what happens if you regularly invest $95.97 at the beginning of each month for 30 years instead of $3,200:

Saving and investing only $95.97 per month, will end out being somewhere over $217,532 in 30 years.

Although your return is minimal in the first year ($64.33), at about the tenth year your wealth should usually start to grow at a really accelerating rate as your money (and its return) generates more and more additional growth.

Finally, the savings of $95.97 per month will make you more than $217,532, or £159,059.40 (GBP)!!!

Most of your wealth will come from the return ($184,262.40), while monthly payments account for only a small part of your total wealth, i.e. $34,549.20 (= 360 months x $95.97).

What We Aren’t Taught In School

Now that you know what it means to put your money to work, let’s see how you can get it to work for you.

But first, let’s clarify some important basic concepts that are extremely important for you to understand if you want to put your finances in order and build wealth.

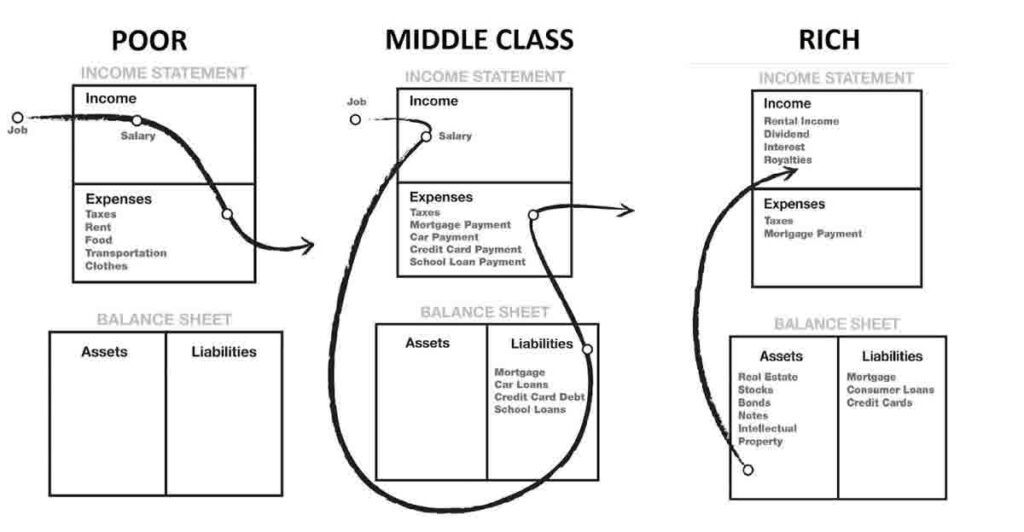

These two concepts are assets and liabilities. Unfortunately, most people are unaware of the difference between the two, setting them on a lifelong financial slope in the wrong direction.

Assets will bring you money, while liabilities will take money out of your pocket.

Assets include shares, bonds, rented properties and other income-generating assets which will, as we have already stated, bring you money.

In contrast, liabilities include your car and apartment, credit card, consumer credit and any other debt form you have.

Another two important accounting concepts* are the income statement and the balance sheet. The profit and loss account shows your income and expenses, as well as the difference between the two.

The balance sheet lists your assets and liabilities at a given time.

The Formula For Wealth

According to the author of the popular book ‘Rich Dad Poor Dad’, the main difference between rich and ordinary people is that while the rich focus on increasing their assets, ordinary people accumulate obligations.

The average person’s only source of income is their job and the main direction of his cash flow is outwards.

It is clear that liabilities take money out of your pocket and deprive you of additional sources of income without actually owning the individual assets.

This perfectly shows that the average person works only for others:

- the employer for which he pays with his time

- the state, since most of his gross income goes to the state in the form of taxes, and

- the bank, since he has to sacrifice most of his income to repay the accumulated loans

In contrast, the rich don’t work for their money and instead, the money works for them!

On the balance sheet of the rich, we mostly find income-generating assets. These assets continuously generate money in the form of income, dividends, interest and other passive income – for example from rented real estate.

Your House And Car Are, In Fact, Obligations

From an accounting point of view, your house and car are also listed on the balance sheet as assets. Using the aforementioned definition though, an asset will only generate money. However, our house and car use up our resources and are actually liabilities.

Why?

Your house, which you use for your own housing, will not generate money for you but will take money out of your pocket and usually in larger portions (Mortgage repayments to the bank, as well as various taxes, insurances, renovations and maintenance costs, etc.).

Obviously, we are not saying that you should not have a house or an apartment, but merely that we want to refute misinformation, such as the often heard – “it is worth buying a house because it is a good investment”.

In a general sense, it would not be a returnable investment to take on a house, etc. until you take steps to start earning from it, such as renting the property out to another party.

It’s the same with the car. Although it does have its own respective worth – usually 4 figures or more- this is not an investment, as it is not an income-generating asset. It’s actually an obligation because you will have to continually take out of your own pocket for the running and upkeep.

The following example is great and illustrates the difference in thinking between rich and ordinary people:

Ordinary people use their money to buy a German car, the value of which is constantly declining and costs money for maintenance. This is one of the main obligations of the average person today, which is largely due to the fact that the expensive car has become a status symbol in today’s society.

Conversely, if they had invested their money in the German stock index instead of the German car, which had tripled in value over the same period of time and paid dividends, they would have increased their wealth.

Focus On Building Income-Generating Assets

Based on the above, you now know that if you continue to accumulate obligations, you will probably work for someone else for the rest of your life in order to make your money.

But if you want a more free outlook on life and financial security/independence, it’s important to focus on increasing your assets and reducing obligations where reasonably possible.

These assets will appreciate in price and keep generating revenue for you. Thanks to the effect of compound interest, your wealth and income will also grow exponentially. As you buy more and more assets, your revenue will grow at an ever-increasing rate, which you can spend on buying more assets. This will further increase your wealth and will mean more and more extra income.

Once you’ve managed to accumulate growing wealth which is consistently above the costs of covering your living expenses, you’ll never have to work again. This blog is also about achieving this goal.

So, in theory, you can use your money to redeem your own financial freedom and take control of your life.

However, it is important that wealth-building works in the long run, unless you win the lottery, so patience is a must and certainly is more than just a virtue. The example above shows that, although yields are minimal in the early years, as your money generates more and more money, compound interest will have an effect over time and your wealth will show exponential growth.

This is why it’s perfectly okay to start off small, and exactly why large initial investments aren’t necessary – The most important thing is to take the first steps and get started.

The secret to building wealth is actually simpler than you think: save as much as you can and invest the difference in income-generating assets.

According to Albert Einstein, “Interest rate is the eighth wonder of the world. Anyone who understands gets it. Those who don’t understand will pay.”

Whether you get it or pay it is up to you.

Which one do you choose?

Read more from Us

—————————————————-

*The third is the cash flow statement, but this is not relevant for this article.