Why Saving Money is Crucial for Your Financial Success

Welcome to our guide on saving money! We all know that saving cash is important, but it can be tough to know where to start. That’s where this article comes in. We’ll go over the basics of saving money, give you some tips and tricks to help you build up your savings, and discuss strategies for reaching different financial goals.

So, what exactly is saving money? Simply put, it’s setting aside a portion of your income for the future. This could be for short-term goals like a vacation or a home improvement project, or for longer-term goals like retirement or your children’s education. Whatever your goals, having a healthy amount of savings can give you peace of mind and help you navigate through unexpected expenses or setbacks.

We’ll kick things off by talking about how to assess your current financial situation and set some savings goals. So let’s get started!

Setting Savings Goals: How to Determine What You Need to Save

Assessing your current financial situation:

Before you can start saving money, it’s important to get a handle on your current financial situation. Here are a few things to consider:

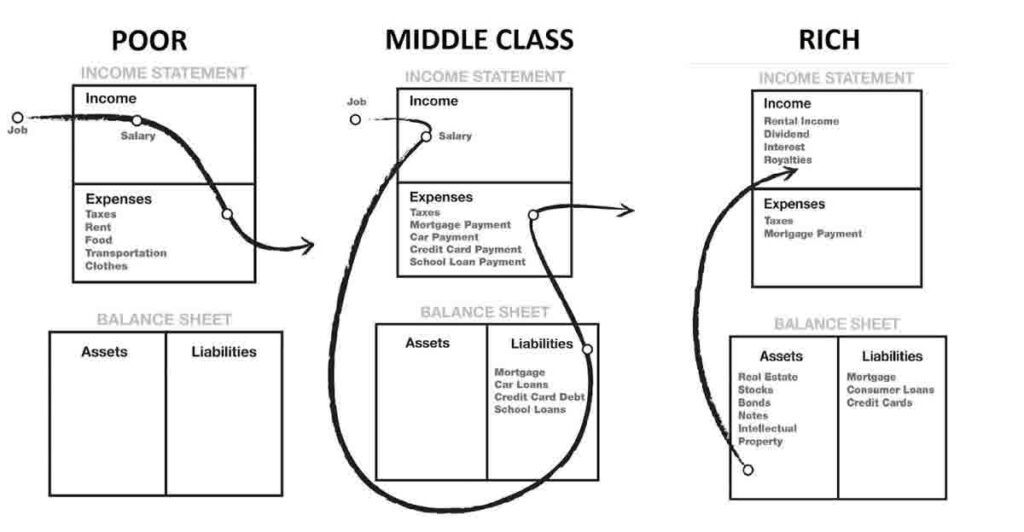

- Make a budget: This is a crucial step in saving money. A budget helps you understand how much money you have coming in each month and how much you’re spending. You can use a budgeting app or spreadsheet to track your income and expenses. Make sure to include all of your fixed expenses (e.g., rent, car payment) as well as variable expenses (e.g., groceries, entertainment).

- Set financial goals: What do you want to achieve financially? Do you want to pay off debt, save for a down payment on a house, or retire early? Whatever your goals, it’s important to have a clear plan in place. This will help you determine how much you need to save and give you the motivation to stick to your savings plan.

- Examine your expenses: Take a close look at your monthly expenses to see if there are any areas where you can cut back. Maybe you’re paying for a gym membership that you never use, or you’re spending too much on takeout. Every little bit adds up, so try to find ways to trim your budget where you can.

Once you’ve assessed your financial situation, you’ll have a better idea of how much you can afford to save each month. This will help you set realistic savings goals and get on the path to building a healthy savings account.

Maximizing Your Savings: Tips and Tricks for Success

Tips for saving money:

Now that you have a better idea of where you stand financially, it’s time to start building up your savings. Here are a few strategies that can help:

- Cut unnecessary expenses: Ser aside time to thoroughly assess your finances and see if there are any expenses that you could reduce or even eliminate entirely from your outgoings. Maybe you can cancel that subscription service you never use, or switch to a cheaper phone plan if you don’t need all of the allowance you currently pay for. Remember, every little bit counts and will make a positive, or negative, impact when it comes to saving money.

- Increase your income: If you’re struggling to save on your current income, consider ways to boost your earnings. You could consider asking for a raise at work, take on a side hustle, or even sell unwanted items, that you no longer need, online.

- Automate your savings: One of the easiest ways to save money is to set up automatic transfers from your checking account to your savings account. This way, you won’t have to remember to transfer the money yourself and the temptation to spend it will be fully removed.

- Take advantage of financial tools and resources: There are plenty of tools and resources out there that have been developed to help you save money. You can even use a budgeting app to track your spending, invest in a savings account to earn more interest, or use coupons and cashback apps to save on purchases.

By following these tips, you’ll be well on your way to building up your savings and reaching your financial goals. But these are just a few; on the way, you will learn many more.

Avoid These Common Mistakes When Saving Money

Common mistakes to avoid:

Saving money isn’t always easy, and it’s easy to fall into traps that can derail your progress. Here are a few mistakes to watch out for:

- Not saving enough: It’s important to save a significant portion of your income, especially if you have long-term financial goals. Don’t be tempted to skimp on your savings in favor of short-term pleasures.

- Not having an emergency fund: Life is full of surprises, and it’s important to have a cushion in case of unexpected expenses. Aim to save at least a few months’ worth of living expenses in an emergency fund.

- Not saving for the long term: It can be tempting to focus on short-term goals, but it’s important to also think about the long term. Don’t neglect your retirement savings or other long-term goals in favor of more immediate needs.

- Not reviewing your budget regularly: Your financial situation can change over time, so it’s important to review your budget regularly to make sure you’re on track. If you’re not saving as much as you’d like, take a look at your budget to see if there are any areas where you can cut back.

By avoiding these mistakes, you’ll be better equipped to save money and reach your financial goals.

Tailoring Your Savings Plan to Your Goals

Strategies for saving for different financial goals:

Depending on your goals, you may need to approach saving money in different ways. Here are some strategies for saving for different types of goals:

- Saving for short-term goals: If you have a specific goal in mind that you want to save for, like a vacation or a home improvement project, it’s important to be disciplined and stick to your budget. Consider setting up a separate savings account specifically for this goal, and try to contribute to it regularly.

- Saving for medium-term goals: If you have a goal that’s a bit further off, like buying a car or paying for a wedding, you may need to save more aggressively. This could mean cutting back on expenses or finding ways to boost your income.

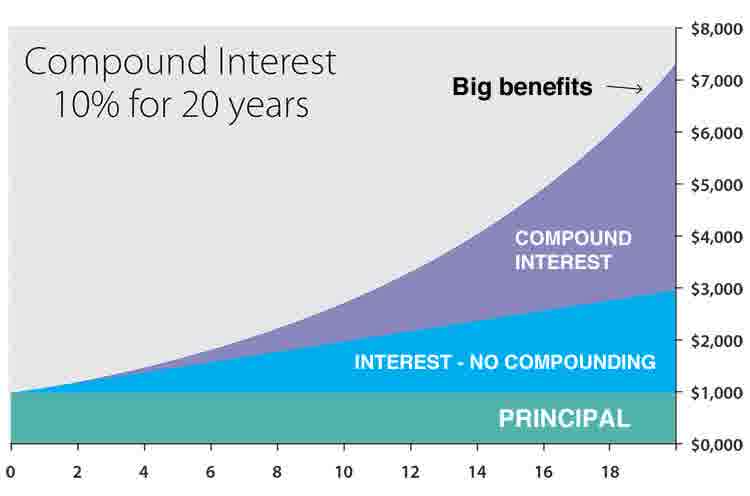

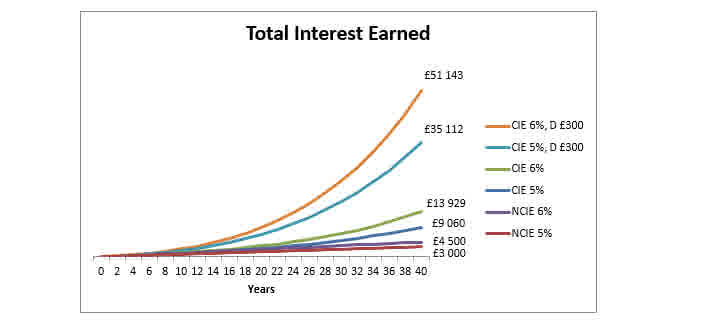

- Saving for long-term goals: When it comes to long-term goals like retirement or your child’s education, it’s important to start saving as early as possible. The power of compound interest can work in your favor, so the earlier you start saving, the more time your money has to grow.

No matter what your financial goals are, it’s important to have a clear plan in place and stick to it. With discipline and dedication, you can reach your goals and build a solid foundation for your financial future.

Congratulations! You’re on Your Way to Building a Solid Savings Plan

In this article, we’ve covered the basics of saving money, including how to assess your current financial situation, tips for boosting your savings, and strategies for saving for different types of goals. We’ve also discussed common mistakes to avoid when saving money.

By following these guidelines, you’ll be well on your way to building up your savings and reaching your financial goals. Remember, it’s never too late to start saving, so don’t wait any longer. Start putting a plan in place today and take control of your financial future.

Now that you’ve finished this article, it’s time to take action. Choose one or two strategies that you can implement right away, and start building your savings today. The sooner you start, the more time your money has to grow and work for you. Good luck!