How should we invest if inflation remains high?

Those who expect persistently high inflation should think about inflation-tracking retail government securities centred around the US Dollar and the Euro. But, on the other hand, with the right timing, commodity investment funds and stocks also have the potential to perform well.

Inflation is likely to be only temporarily close to 6-7% in the US. From the second half of 2022, the consumer price index may gradually return to close to 2-3 percent, based on expectations.

If it is predicted that there will be higher inflation on more of a permanent basis, you may want to choose the following forms of savings.

Raw materials

If we turn to the universe of risky investments, commodity investment funds can perform well in a high inflation environment.

In the post-coronavirus period, many governments around the world are invigorating with improved infrastructure measures. Meanwhile, the supply side faces a capacity shortage and supply chains are faltering. After the closures, a significant demand hit the construction industry worldwide, but trade and geopolitical tensions also pushed up the price of raw materials.

Moreover, the supply chain is relatively inflexible. For example, it takes a good two years to create a modern sawmill, while opening a new mine may take up to a decade.

Through their bond-buying and liquidity-enhancing programs, central banks have injected huge sums into the banking system and economy on the demand side of things. This money is present as a demand, raising the price of commodities. This links to the increasing number of wage increases.

This environment has led to significant price increases in the raw material markets.

After the prices of many raw materials have doubled in recent times, the question is whether or not it’s worth entering trades or investments after such a significant increase and buying, for example, a commodity fund.

Suppose China could avoid a slump in its real estate market and a significant slowdown in its economy. In that case, commodity price increases may continue for some time to come, although the pace is likely to moderate. The significant price increases may be behind us.

Shares

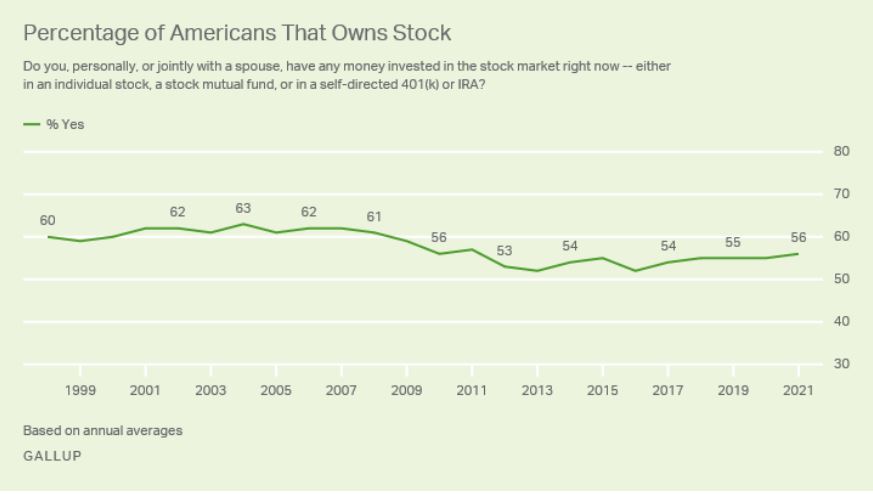

Domestic, German and U.S. stock markets are at historic highs. Stocks have traditionally performed well in higher inflation environments. If inflation is too high, it can be harmful. In this case, central banks will have to make significant cuts.

Higher inflation is particularly concerning for the U.S. Federal Reserve (FED).

In the United States, the rate of economic deterioration rose to a 13-year high of 5.4 percent. One-year inflation expectations jumped to 5 percent, and 3-year inflation expectations, which better capture longer trends, jumped to 4 percent overseas.

As a result, the FED could phase out its bond-buying program entirely by the middle of the year and even begin a cycle of rate hikes. However, this can trigger a negative correction in equity markets.

In light of this, it is advisable to buy shares in the form of several positions (known as dollar-cost-averaging), with more of a long-term view. This technique can reduce the risk at the time of purchase.

If a 10-15% correction were to develop in the equity markets, it could be another possible point of entry.

In this case, the extreme optimism in the markets could be tempered, investors’ cash holdings could recharge, while the pricing of equity markets would also return from the current very high levels.