Have you ever wondered how rich people have come to have more money than most?

Commonly it is believed that those who are more financially well-off either just struck lucky, gained fortune from wealthy families, or somehow made their fortunes fraudulently.

This is most usually a massive misconception and those who believe this have to change a lot in order to be able to make a great fortune for themselves.

Most rich people have worked very hard to achieve their financial goals. Over time, these individuals have learned how to manage money and know what needs to be done to ensure that their passive income – if they have one – continues to increase their wealth.

In this article we will overview how to manage your finances

Table of Contents

1. 1. Tracking Costs and Creating a Budget

2. 2. Set up an Emergency Fund

3. 3. Repay Your High-interest Loans

4. 4. Invest in Yourself

5. 5. Invest in Shares and Real Estate

6. Act!

Money is an integral part of our lives because it affects all areas of it. If you don’t have much money, then you may find that at least one of the following applies to you:

- You have to work very hard in order to make a living.

- You don’t have any disposable income and so can’t spend on your own needs.

- You don’t have the opportunity to travel abroad and see the world.

- You find it difficult to create the right environment for your family.

How much of a relief would it be if you were in a position were all of these things could be done at any given moment.

There is no recipe for wealth

Everyone gets rich in different ways, this is because each method will suit different people differently, but rich people have many similar habits and qualities.

It is a fair suggestion to say that the top 1% share the same view of the benefits and importance of money and that these people live almost identically when you take most of their spending habits into account.

1. Tracking Costs and Creating a Budget

How can you change something you aren’t aware of?

You can only create a better financial situation for yourself if you know exactly where your money is going.

Richer people may have more of a healthy level of wealth, but they know exactly how much they pay, where they spent it, and on what.

Most people don’t pay much attention to a budget and in fact, most of us only know how much we get paid in a month and manage our finances according to that entire amount until we get the next payment, when we do the same thong all over again.

That’s not how successful people manage their money.

For the next two months, track your expenses, as well as your incomes.

You can do this with the help of a piece of paper, but then you will have a better chance of forgetting certain things. The easiest and most effective way to track your spending is to use a phone app that will track both incomes and outgoings for you. Note, this will require you to input data as you go.

Some useful income/expense tracking apps include:

By following these steps, you can also increase your savings:

Tracking costs

Step 1

Record all expenses and incomes

As well as noting what incomes you have within any given month, also keep track of all expenses that take place in that month, all the way down to the last penny/dime. This ensures that all of your money is accounted for and you know where it is all going, giving you a much clearer bigger picture.

Step 2

Assess each month

At the end of the month, work out what you’ve spent most of your income on and identify if and were changes can be made to your spending habits. This is a crucial part of how you will now manage your finances.

Step 3

Don’t buy because of sudden urges

Most people realize that impulse buying greatly increases spending. Despite this realisation, it may not occur to the same individual that, if you only buy what you really need, you can improve your financial situation a lot.

Of course this isn’t to say that you can’t treat yourself every once in a while, but just be sure to keep a handle on unnecessary spending as this can absorb a lot of your income if you aren’t careful.

Step 4

Work out how much you can reasonably save

Once you’ve gone through all of your expenses, you can then compare these figures to your level of income to be more able to determine just how much money you could set aside and invest into more useful purposes each month.

Try to continually work on this so that you can gradually increase it from month to month.

2. Set up an Emergency Fund

Every person with considerable wealth, and even as well as those with any level of disposable income, almost always have an emergency fund that allows them to cover their expenses for at least 3-6 months simply to have just in case their personal circumstances change.

So how do you go about building up this fund?

The answer to this is simply using an appropriate proportion of the money you can now regularly save each month to set up your own emergency fund and to then manage your finances so that you don’t use that money unless you find yourself in a situation when you really need to – for example, if you were to lose your job.

As we had said earlier, if you keep track of your expenses properly you’ll know exactly how much money you spend each month. It is then this figure that will help to determine how much your emergency fund needs to be in order to cover everything you will need it for when the time comes.

Your goal should be to save this amount as soon as possible.

Only use the money you save if you have unexpected, urgent costs. This will protect you from borrowing, which usually is a long-term commitment that may even take years to be paid off.

It can be a lifesaver

For example, when you have your fund mostly set up, should you have a large unexpected expense, you won’t have to make arrangements with your landlord to be able to afford your rent payment and you certainly won’t need to take out a loan.

If you have sufficient reserves for such an expense, you will be able to pay the amount without any problems and no sacrifices are necessary.

3. Repay your high-interest loans

Whatever credit you have, it is worth consolidating where possible and getting it paid off as soon as is reasonably possible. If you are paying off a long-term high-interest loan, in some circumstances, it may be worth replacing;

Debt settlement credit is beneficial

With the help of a debt settlement loan with a favorable interest rate, you can pay off your current loan and replace it with a cheaper, more affordable loan.

A debt settlement loan can be applied for at almost any bank and operates on similar terms as a personal loan.

Before entering any contract it is important to pay your due diligence, but you should certainly find out more about debt settlement loans before deciding to use one to try and help your personal situation, if you don’t then you may make it even harder for you to manage your finances, but as long as you listen to advice and don’t rush into anything, you should be perfectly fine.

If you do not want to apply for a debt settlement loan, you can also use one of the following methods to help make repaying your loan easier:

Avalanche method

This is usually the best way to repay your debt – especially when you have multiple loans – as it will cause the least amount of extra cost.

The essence of this method is to settle your loans based on the level of interest they carry. Put simply, when following this method loans with the highest APR are the first to be paid off.

Further to this, once you have then managed to pay this higher rate loan off, continue by paying off the second-highest until, eventually, you only have to pay off the last loan which has the lowest interest rate.

Snowball method

This method is similar to the avalanche method in the way that you pay your debts in a predetermined order, only here you will first pay off the loan that equates to the smallest amount of credit. This will certainly be easier to sort out, and so you should see the results of your work sooner.

As we have already said, in the snowball method, you do not take into account interest, only the total amount of credit to be repaid.

The advantage is that you will feel the success and therefore it will be easier to pay off the next loan.

The disadvantage of this method is that you will pay more on interest than in the case of the avalanche method.

4. Invest in yourself

Once you’ve set up your emergency fund, paid off your debts, you should invest in yourself and gain knowledge which will, in turn, help you to make more money looking forward.

What is considered to be self-improvement?

- Reading new, informative books

- Investing in learning a new skill (i.e. completing a course)

- Starting your own business

- If you already have your own business, you can invest in it to improve and develop it further

If you’ve done everything you can to create a better financial situation for yourself, for example, you now have savings, can effectively control your money, and money doesn’t dictate how you live, then you can now manage your finances well, and it’s time to consider the different ways to bring in new forms of income and start earning more.

You can’t completely create a better financial situation for yourself if you don’t take the opportunity to learn new, important ways to make money.

The possible result of having an open mind to these methods could be:

- A raise in pay

- A promotion

- Movement into better, more well-suited job roles

- Being able to start your own business

If you have money set aside and get rid of loans as we previously explained, you could potentially take on more risk, which is usually essential to successfully gaining more money.

5. Invest in Shares and Real Estate

Starting your own business is not an easy task: it takes a lot of perseverance to get started and for a company to succeed a lot of time, effort and general work is needed to be put into it. This also includes developing a portfolio of assets and, if you work hard enough, your business can be your most profitable asset.

If you are a person that aspires to be able to eventually live a quiet life whilst knowing that you have a secure job: there is a way to earn more income.

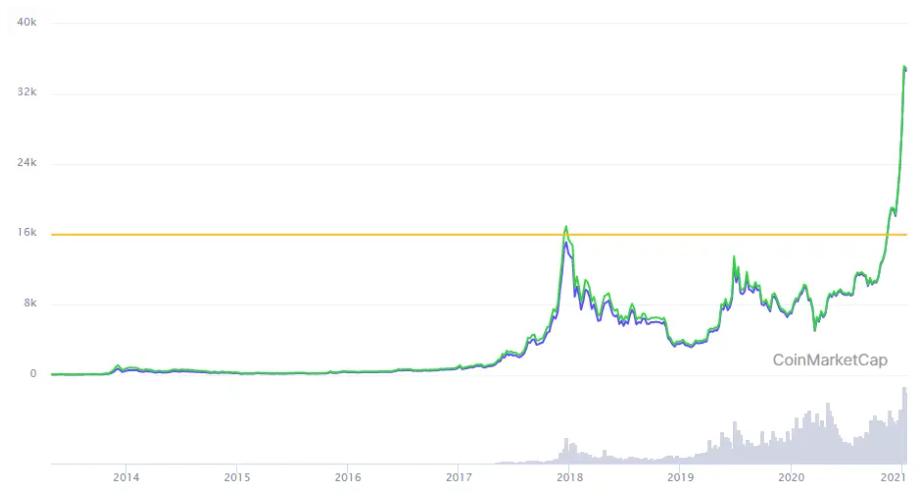

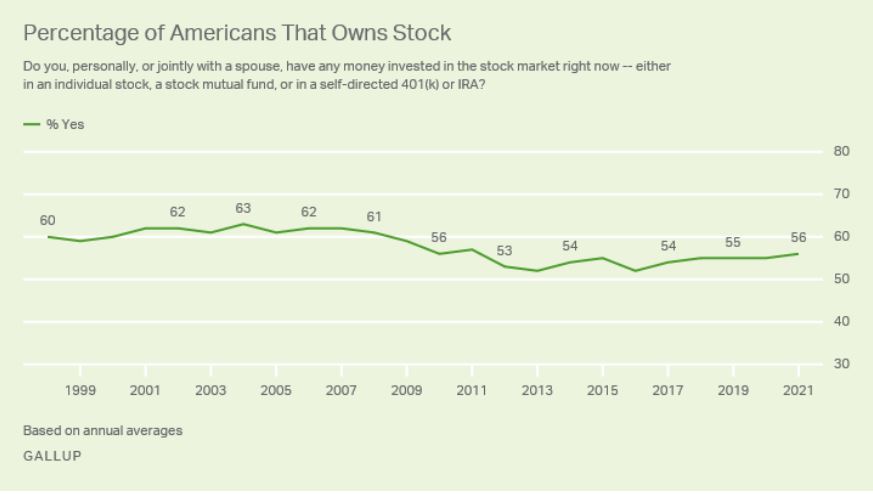

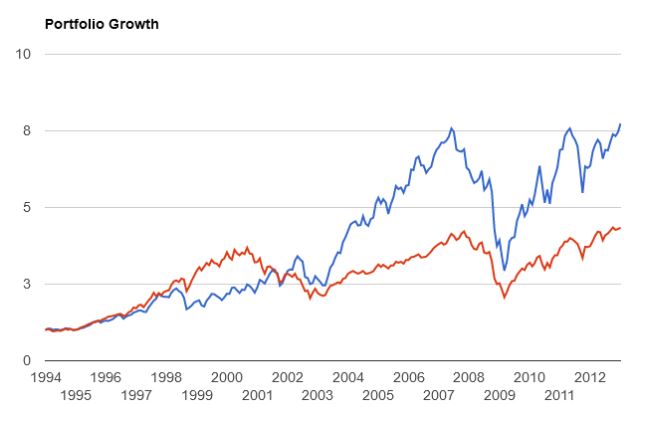

The most affluent people invest their wealth in different areas and diversify their investment portfolios. The most popular investments are usually stocks and real estate.

Investing safely

Before you invest, it’s good to identify the area that piques your interest the most.

It is important to note that, before you choose the area you are wanting to invest in, examine the different areas and compare their level of risk. Find an investment that suits you both in terms of capital and risk.

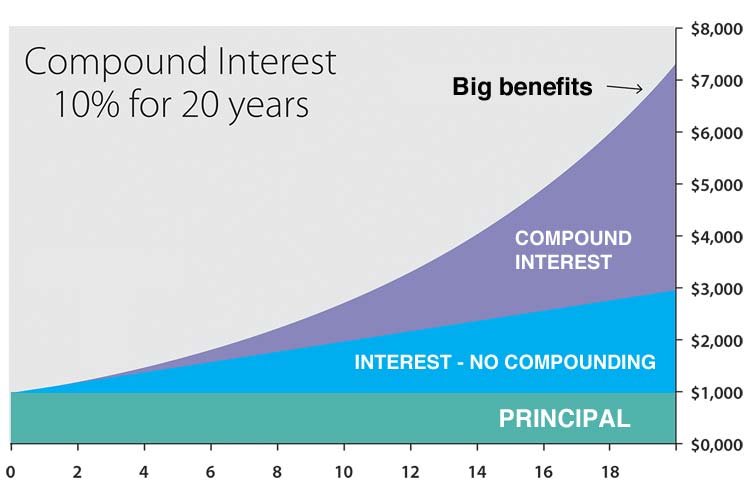

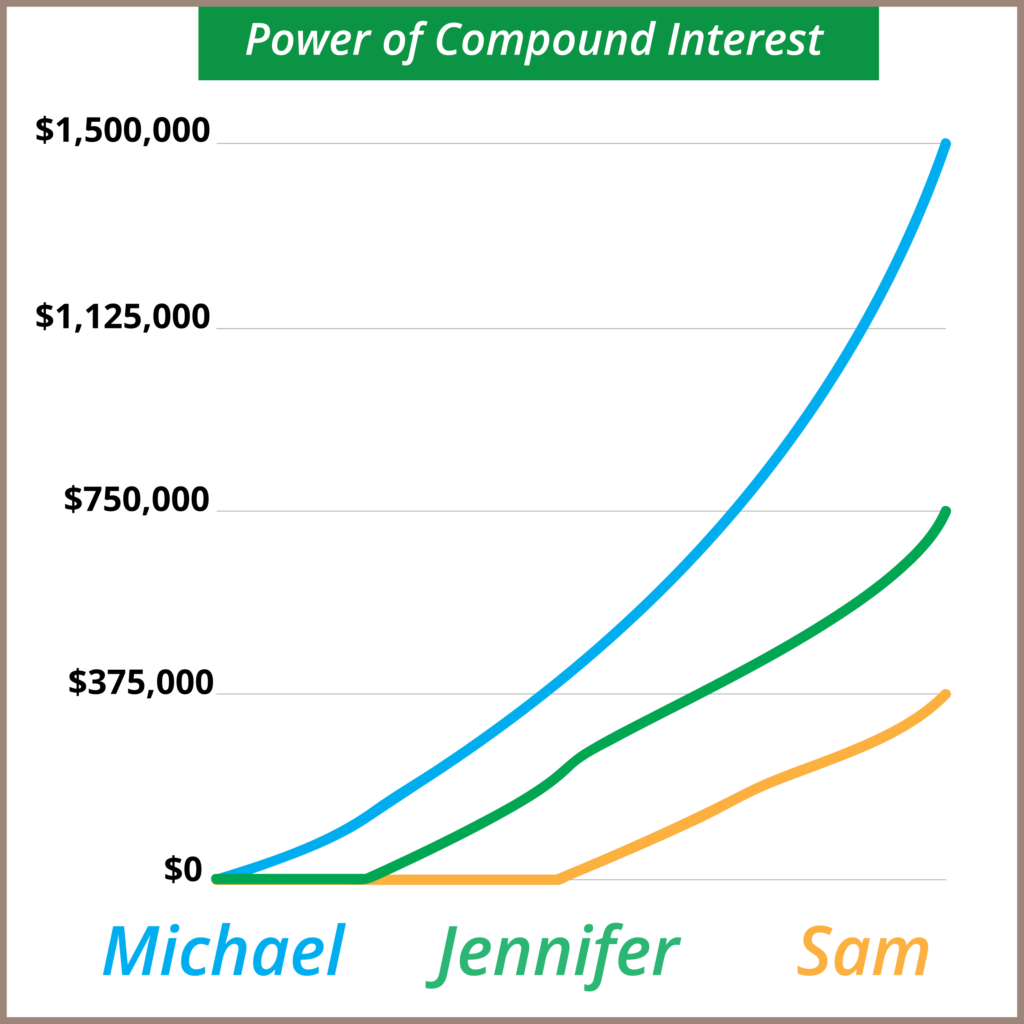

Remember, long-term investing is usually safer and more rewarding. For novice investors, it is not recommended to think in the short term.

The best way to manage your finances? Act!

These steps can seem very difficult, especially if your personal situation means you are currently still struggling with debt.

If you follow the aforementioned steps and feel like you aren’t getting anywhere fast, don’t be too concerned and carry on accordingly. It can sometimes take years for most people to turn their personal situation around and get to the point where they can begin to think about investing.

Try to complete the steps in sequence and begin developing the right habits. It is these appropriate spending and accounting habits that can save you a lot of money in the long run.

Synopsis

The top 1% live by strict rules and manage their money so that every penny/cent has a purpose

Investing is a very important part of collating wealth, so it is worth starting to manage your finances as soon as you can so that you can then begin putting your money to actual constructive use as soon as possible.

Read more about how to manage your finances and gain financial independence here.