Making Money Quickly

How do I get money fast? – A lot of people will often find themselves asking this question more often than you would think.

If this is what you’re currently asking yourself, you have come to the right place. Below you will find the top 15 methods that can be considered the best way to make money quickly (with examples!). We have tried our best to make these options as accessible as possible, i.e. for anyone and everyone who is looking into this topic and so there are varying levels of suitability.

Also, please remember that some of these potential possibilities will require a small level of time investment (over a month) for you to see the full benefits from that particular option.

No matter how long you have left of your working life or what your qualifications are, you will surely find a suitable opportunity for you.

Let’s see;

1. Sell Your Barely Used Clothes

Selling clothes you no longer use is one of the quicker ways to make money. If you want to get rid of them quickly, you may want to visit a local second-hand clothing store where you can instantly cash-in on unused clothes. This kind of business includes Cash4Clothes, a company that will pay a set cash amount per kilo of clothing articles.

In the online space, you can also do this on various websites, such as Vinted, Shpock and Depop.

If you wanted to go the extra mile, you could even try to sell them on your own, in one of the ad hoc selling communities, e.g. Facebook Marketplace and some Facebook groups centred around selling. Although please note that here you should pay close attention to taking high-quality photos and using competitive pricing to have the most streamlined experience with this.

2. Sell Old Phones and Other Tech

Do you have an old phone, laptop or unused console? This is a good example of making money quickly, as you can instantly convert your old or unused gadgets into money.

Today, the fastest way to do this would likely be on Facebook Marketplace. Some good photos and an apt description will almost always work wonders. Just like with our previous point, there are also Facebook groups dedicated to the buying and selling of preloved tech and so taking a look at these will usually bear low-hanging fruits when it comes to selling opportunities.

If you don’t have time to create listings or posts and need money faster than this, you can instantly convert your gadgets into cash by utilising stores such as CashConverters, who will review and buy your items, although here earnings will be lower than market value as they will need to take into account the re-saleability of the item(s).

If you’re an Apple user, consider Apple’s device replacement. If you purchase a new device, your old device will be included in the purchase price of the new item.

Another option would be Amazon’s Trade-in program. Here you can get an Amazon gift card for unused electronics products. When it comes to what is regarded as acceptable item condition, this is what they state on their Trade-in program page: ‘We currently accept items ranging from non-functional to good condition. To be paid at the highest value for your trade-in, your device must be in good condition.’ They then go on to link their Electronics Eligibility Criteria which goes into further details for the respective condition categories.

3. Be a Food Courier – JustEat, Deliveroo and UberEats

Food delivery has always held its ground, allowing it to continually develop as an income provider. This has only been further boosted over the past couple of years by the pandemic. You may want to take advantage of the ever-increasing trend of recent years and sign up as a courier, as this is also a super quick way to earn money.

Nowadays, you will find ample opportunity to apply for this type of role and what’s more, you don’t even necessarily need a car, just a bike or even a scooter. In many cases, just like with JustEat, a bike and all necessary equipment can be provided by the company, if necessary, if you are able to reach their central hub.

The beauty of this is that, if you have one, it can easily be managed alongside your everyday job.

This is because it doesn’t have to be full-time and hours can be shaped to meet your needs, whether it be just a few extra hours a day or only on weekends. In addition to making money quickly, this option also greatly benefits your health considering how you will have to get around.

All that is usually needed is a quick online registration and, sometimes, a deposit. Then you can get to work right away.

Learn more about how to get started with JustEat or Deliveroo.

4. Give Away Your Unwanted Gift Cards

Have you ever received a gift certificate for a birthday from a brand that you knew right away that you won’t use it?

You may want to sell these vouchers as soon as possible for quick cash, although, just like with used tech, it will most probably be for a fraction of the face value.

A couple of examples of sites dedicated to the safe buying and selling of gift cards in the UK would be Cardyard and Zapper.

In the US, the more well-known name in this field would be CardCash.

Here are some blogs that are written more specifically for this topic:

UK:

US/Canada:

5. Take Freelance Work Online

While it may not always be one of the quick ways to make money, one of the most popular forms of online monetisation today lies within the world of freelance work.

Freelance sites offer job opportunities in all disciplines, from programming to marketing, to video editing, all the way to education.

The biggest advantage of working as a freelancer is flexibility. You can decide for yourself when and how much you want to work. You are also free to choose whether you want to do it all from home in bed or remotely while lying on a beach somewhere.

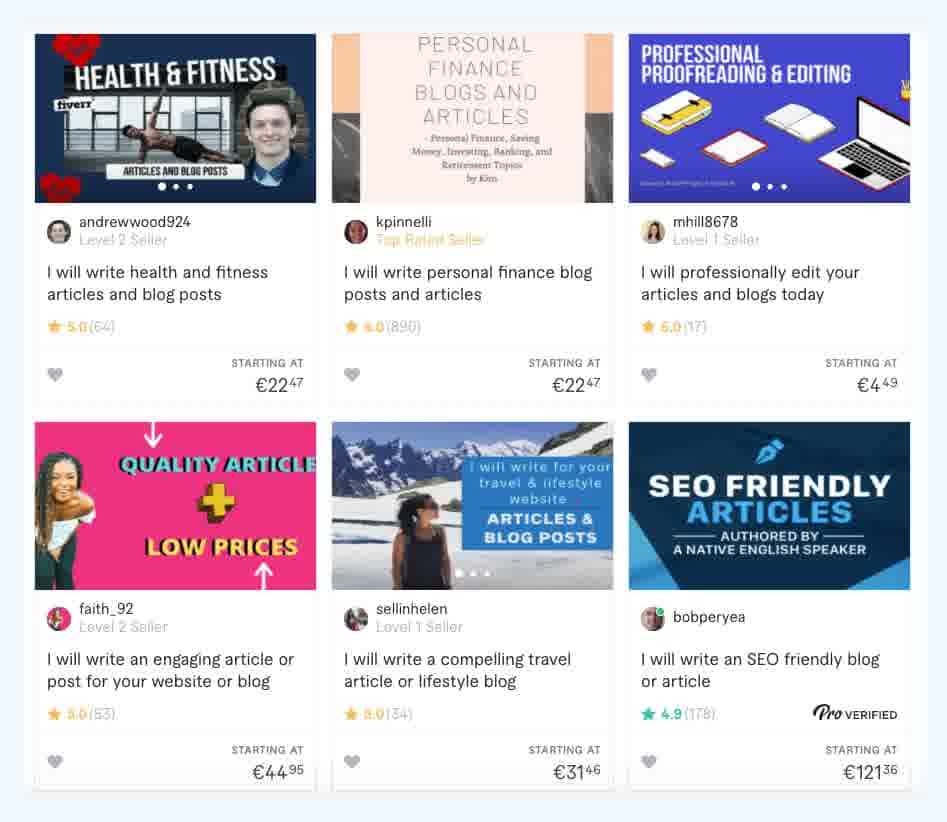

Undoubtedly one of the most popularly known freelance sites today is Fiverr, and another is Upwork. Whatever knowledge or experience you have, chances are you can turn it into money here.

Don’t forget, there’s a demand for practically everything!

For example, if you like to write and would love to write blog posts for others, do it in return for a fee. You’ll need to post an ad that says the topic you want to write about, the price and when they find you, you’ll be hired.

But if you want to use your good dexterity, online logo design is a good idea.

Countless online businesses are now looking for unique, creative logos to stand out from other companies. You can upload your portfolio, which will be used by companies to select you.

Also, it is completely possible to find works written specifically in your chosen language on Fiverr’s website. Various translation works, English teaching or even dubbing, the decision is yours.

For example, if you like to write, there are also Facebook groups that are specifically created to promote freelance jobs. The most well-known group has loads of members, so you might want to take a look there too.

It is also important to note that anyone who commits to freelance work, no matter which area they’re hired in, should always inform clients of the most up-to-date, most relevant prices before any agreement is reached so that they can make the best-advised decision.

6. Test Websites and Apps

Another, now increasingly popular, form of ‘work from home’ is the world of online testing. In addition to flexibility, the great advantage of this lies in the fact that it does not require any special computing/IT skills.

The first step usually is that the company performs a short test to assess your ability to work, after which you will then be invited to perform the various tests that they require.

In general, we get a fixed, pre-determined wage for performing a test. Within these tests the operation and usability, of different websites and applications, must be thoroughly tested. When detected any errors then need to be reported to the relevant persons.

Even if you aren’t a native speaker of English, but still have a good level of English skills, why not try these sites too when there is a prospect of more work and better wages;

US-based company, UserTesting.com would be a good starting point where you can earn $10 for just a 20-minute test.

7. Rent Out Your Unused Room Online

A relatively quick way to make money is to rent out an empty room, this would of course depend on available space and any relevant legislation. Once again, as long as it is fully lawful, you could even rent out your entire property if occasionally going on vacation. This will mean your property will be giving you a great passive income, instead of sitting desolate during your time away.

We can easily do this on websites that specialize in this, the most popular of which today is Airbnb. After a quick registration, we can create our ad by filling out a few well-taken images and some extra details about the place and its amenities.

As we already said, this is an opportunity that provides a particularly stable source of what is known as passive income for those who want to earn a little extra income without having to commit too much extra time or effort.

However, before anyone goes into it, it is worth noting that the maintenance costs of your home may inflate because of increased usage. We will need more cleaning and we may also have to pay a commission to the service provider (Airbnb for example).

Also, if the house, flat, or apartment isn’t owned by you, it is important to carefully review your rental or tenancy agreement to make sure whether or not it includes a non-rental clause. This is what we meant earlier when we mentioned legality.

8. Rent Your Car Out

The good news is, you could also rent your car!

Do you have a car that you don’t use every day? If your answer is yes, this would be a simple and quick way to make money.

This, by the way, can also be another great passive income option.

Community car sharing has been a great success in Scandinavian countries for many years. This form of car rental is becoming more and more common, in more and more countries, and is modelled on the pioneering Danish company GoMore.

The main advantages over classic car rentals are the affordable price and the simple, hassle-free online booking.

If you’ve got a car from your workplace but don’t want to sell your old car yet, it’s worth taking a look at your local car sharing services, which have the option to rent your car permanently, even for a year.

9. Complete Online Questionnaires for Companies

An easy way to make money online? We’re certain that this is one.

This is so easy that it can be done by sharing thoughts and opinions and completing the online surveys. You won’t necessarily get rich from this but, if you have a few hours to spare, it may be a feasible way of easily earning an extra income.

The more popular sites, which are definitely worth trying are TGMPanel and the National Panel. In the case of the latter, you can redeem your points not only for a cash prize, but also for an object prize, or even donate them to a charity of your choice.

Some sites to consider would be: Best Paid Surveys, SurveyBee.net and Paid Surveys UK.

10. Become a Babysitter

One of the most rewarding jobs is guaranteed to be babysitting. Its beauty lies in the fact that anyone, from a university student all the way up to a grandmother can do it, 1-2 hours a week, or even several days.

Originally, requests for this kind of service were moreso made by friends and family, and, in the case of good performance, it was possible to even form a larger client circle thanks to word-of-mouth references.

But this is much easier and faster these days! Although please do bear in mind that most usually, as children are classed as vulnerable individuals, this would need some previous experience in order to prove your personal credibility.

11. Become a Dog Sitter

Like with babysitting, in today’s world you have the opportunity to take care of other people’s pets for money as well by becoming a dog sitter.

If you love animals, have some free time or and even have free space at home, this job is a perfect choice.

It is worth starting with pages such as Rover.com, DogBuddy and Pawshake.

Once you have registered with the respective site and created your profile, you can then start to take on related work such as dog walking, doggy daycare, all the way up to several days of accommodation – at the price you have set.

12. Sell Your Unused Textbooks

As most people will know, textbooks will usually sell for serious amounts of money. Then, at the end of the school year when they’ve been used to their max potential, they’re the first things in a box and left, forgotten, in the attic.

If you thought there was no market for these books, we have some good news for you!

With forever-increasing tuition fees, as well as general inflation causing everything else to go up in price, students are always looking to reasonably cut costs in ways that make the financial side of things easier for them.

You can easily sell these books online, regardless of the topic, in a number of different places, including Gumtree and Ebay.

Facebook Marketplace would also likely be a good starting place.

13. Rent Out Your Parking Space

Does your rent include sole use of a driveway or garage, but you can’t take advantage of it yet?

If this is the case, then it would definitely be worth considering leasing it out. This is because, with very little energy investment, you can make passive income easily by using a forgone asset.

Especially in larger cities, there is a growing demand for closed car parks, given the ever-increasing parking fees and the continuous growth of the domestic car fleet.

If you want to advertise, it’s a good idea to try using flyers around the surrounding areas or any of the advertisement boards that there may be in your residential building.

14. Talk To Your Boss And Take On More Hours

This may be a very obvious idea, but it can sometimes be very easily overlooked by some.

If you think you’d like to work overtime or want to expand your responsibilities within the company, it’s definitely worth asking to set up a meeting with your boss.

Although not guaranteed, more often than not, a proactive mentality is often rewarded!

15. Sit Down to Discuss Your Wage/Salary

As you can probably tell, this point is very heavily related to our previous one.

A lot of people think it’s completely unnecessary to sit down with our bosses about a pay rise, even though it’s a perfectly reasonable and sensible move.

Anyone who consistently makes the most of their position and performs well within their role, can more certainly expect to start this conversation with good standing due to increased credibility in the eyes of the employer!

Success, as in many other cases, depends on how prepared you are. As mentioned in the previous point, proactive attitudes and careful planning are key to the success of wage development.

Summary: The Best Methods for Making Money Quickly

In this article, we looked at the 15 best ways to make money quickly.

Some options are great for instant making money, but some have greater potential in the longer term.

We sincerely hope that at least one or two of these list entries can help you in some way.

All in all, our most important piece of advice is probably to get started as soon as is possible!

Read more from Us