What is PANCAKESWAP and CAKE good for? A Complete Guide

Despite the frivolous name, PancakeSwap and Cake is no joke; the platform is one of the most significant dApps of all time and regularly attracts $100 million worth of daily traffic. In less than a year, it became the largest DEX on the Binance Smart Chain, beating Binance DEX. Not only this but its native token, CAKE, is keeping itself stable among the top DEX coins.

WHAT IS PANCAKESWAP COIN (CAKE)?

KEY DETAILS*:

Available at: PancakeSwap, Binance, KuCoin.

Competitors: Biswap, UNI; BAKE; SUSHI

Highest price: $42 / $0.00033 BTC

Lowest price: $0.5/ $0.0000135 BTC

*information correct at the time of writing and research

CAKE IS PANCAKESWAP’S OWN COIN

PancakeSwap is the Binance smartchain’s most popular decentralized exchange. Over the past year, PancakeSwap has made an amazing run-up to the blockchain world, building a huge user base with its extensive toolkit being a great attraction to users. The advantage of BSC in DEX compared to Ethereum-based platforms is the low network fee, so it is more economical to immerse oneself into DeFi on PancakeSwap with less money than, for example, UniSwap.

The platform allows you to trade Binance Coin (BNB), and other BEP-20 tokens, directly from the wallet in a peer-to-peer manner. The trades completed by PancakeSwap are finalized and executed by a smart contract without a stock exchange or other traders. The team behind PancakeSwap are completely anonymous, but the smart contract and platform have audits from Certik and Slowmist.

Since its launch in September 2020, PancakeSwap has incorporated all major DeFi trends into its system. There’s token farming, pools, NFTs, sweepstakes, and all you need is one thing – some of the native CAKE token. CAKE is also a governance token, so important Pancakeswap related improvements and decisions are also the collective responsibility and voting rights of token owners.

WHAT HAPPENS ON PANCAKESWAP?

One type of decentralized exchange is AMM (Automated Market Maker), where trading is not conducted directly between buyers and sellers, but customers buy tokens from one (or more) pools and send the other token to the same place to pay for it. There are two tokens in a pool, just as currency pairs consist of two currencies. Without the offer book, there are no opposing offers to buy and sell.

Tokens sold (submitted) and purchased (withdrawn) during trading will shift the ratio of the two tokens in the pool, and the exchange rate that moves in the opposite direction balances the pool in value from both directions. This mechanism is very similar to a depth chart of trading on centralized exchanges, where the relative differences between bids and offers move the exchange rate.

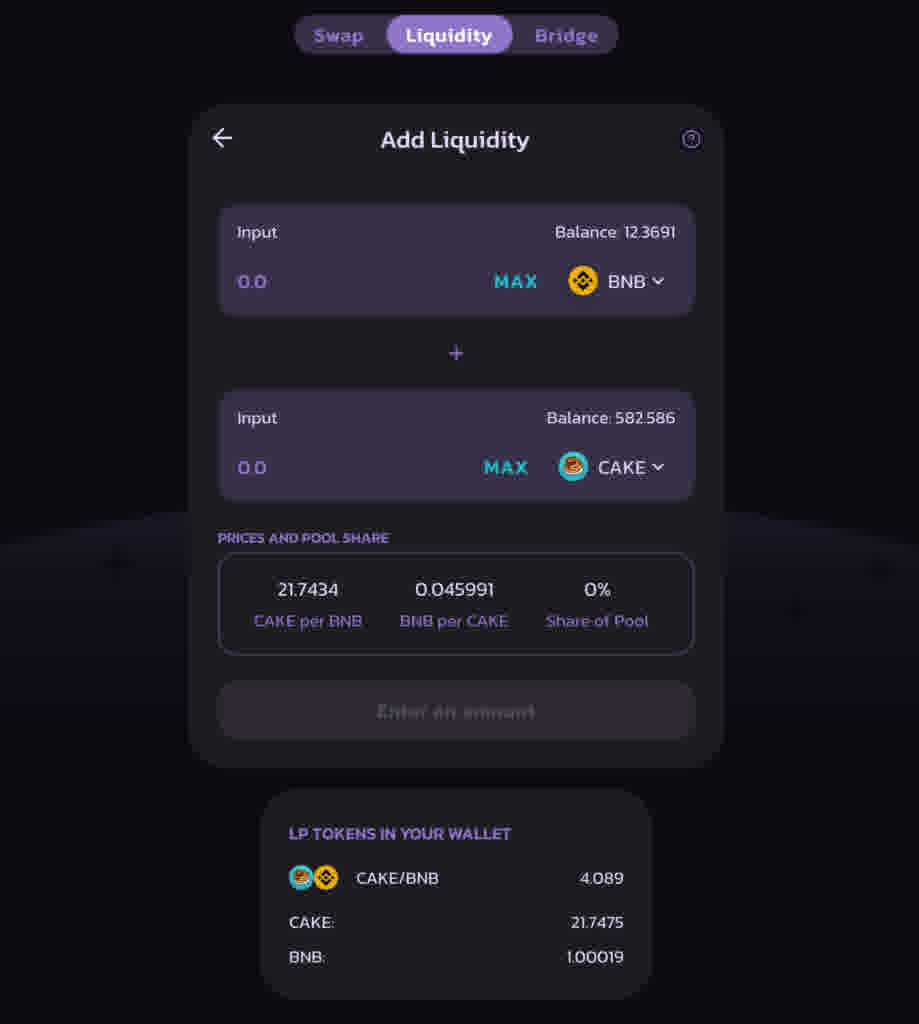

The tokens available in the pool are provided to traders who have temporarily exchanged their BSC-based tokens for liquidity provider (LP) tokens. It requires two different tokens, both of which must be sent to the pool, and the total value of the two is given an LP token that channels the pool’s profits to the LP holders in proportion to their tokens. The profit here is a fixed 0.25% fee for pool-related trades, which is spread among those who allow AMM trading.

For it to be accessible, PancakeSwap requires a Web3 supported wallet. The most popular ones being Metamask, TrustWallet, or WalletConnect. All you have to do is reconfigure the network on these wallets, besides BSC we can connect to similar DEX’s on other blockchains, such as Ethereum, Polygon and AVAX this way. The revenues and costs of the development are all publicly shared, 15% of the trading fees go to a treasury, which is a fund for the cover of expenses, maintenance of the platform, etc.

PancakeSwap has undergone a lot of innovations in a very short space of time, respectively. V2 developed the syrup pools that are now accessible and also introduced their referral program. At the same time, the trading fee jumped from 0.2% to 0.25% – 0.05% of which is then used to repurchase the CAKE token on the open market, these purchased tokens are then burned, thus reducing inventory. Currently there is no specific roadmap that has been released, instead though there is a publicly published to-do-list which doesn’t feature any deadlines. These to-dos include a tied staking product, a loan facility, and NFT prizes for completing tasks and leveling up.

HOW DOES THE CAKE TOKEN RELATE TO DEX?

Like Binance, PancakeSwap has platforms linked to popular forms of investments. DEX links them in some form to the spending or possession of CAKE tokens, thus generating traffic to their own cryptocurrency.

YIELD FARMS

The liquidity shown above is provided with LP (Liquidity Provider) tokens, on PancakeSwap we can also stake these LP tokens and receive a CAKE token as a reward. During stakes, the transaction fee earnings for LP tokens will continue to be retained. Annual interest varies from farm to farm, and, in some places, it can certainly reach several hundred per cent. There is always another side to yield, especially if it looks unrealistically high, in the case of yield farm-to-farm interest, this is the impermanent loss that you can read more about in our other article.

SYRUP POOLS

The Syrup pool at PancakeSwap is the stakes corner. A wide range of BEP-20 tokens can be staked here as a community. Reward can be that token, or it can be CAKE. The interest rate on the stake is variable according to the rules of the given token, and the exchange rate movements of the tokens converted to stakes are included in the actual investment result.

LOTTERY V2

Tickets can be purchased with CAKE token, which is discounted in large batches, and the prize pot is made up of even more CAKE. 40% of ticket revenue will be allocated by the smart contract to ticket holders with all six matching numbers.

BET ON EXCHANGE RATE

It is also a simple feature. The price of the BNB coin can be accepted in a five-minute perspective. The returns made from those who lost the bet is distributed among those betting on the winning side.

NETWORK MANAGEMENT WITH CAKE TOKEN

Also on PancakeSwap is the site where the votes on important issues affecting the ecosystem take place. The right to vote is linked to the CAKE token or indirectly to its owner. Like a board meeting of a public limited company, most CAKE tokens are implemented here.

The proposals can be published by anyone who undertakes to promote their idea, not just the founders and leading developers. The community thus seeks, at its discretion, to introduce changes that benefit everyone because they depend on each other. Liquidity insurers will not vote for unrealistic trading fees, because if traders turn away from the pools, there will be no trading fees to share.